More posts by this contributor

B2B e-commerce company Sokowatch closed a $2 million seed investment led by 4DX Ventures. Others to join the round were Village Global, Lynett Capital, Golden Palm Investments, and Outlierz Ventures.

The Kenya based company aims to shake up the supply chain market for Africa’s informal retailers.

Sokowatch’s platform connects Africa’s informal retail stores directly to local and multi-national suppliers—such as Unilever and Proctor and Gamble—by digitizing orders, delivery, and payments with the aim of reducing costs and increasing profit margins.

“With both manufacturers and the small shops, we’re becoming the connective layer between them, where previously you had multiple layers of middle-men from distributors, sub-distributors, to wholesalers,” Sokowatch founder and CEO Daniel Yu told TechCrunch.

“The cost of sourcing goods right now…we estimate we’re cutting that cost by about 20 percent [for] these shopkeepers,” he said

“There are millions of informal stores across Africa’s cities selling hundreds of billions worth of consumer goods every year,” said Yu.

These stores can use Sokowatch’s app on mobile phones to buy wares directly from large suppliers, arrange for transport, and make payments online. “Ordering on SMS or Android gets you free delivery of products to your store, on average, in about two hours,” said Yu.

Sokowatch generates revenues by earning “a margin on the goods that we’re selling to shopkeepers,” said Yu. On the supplier side, they also benefit from “aggregating demand…and getting bulk deals on the products that we distribute.”

The company recently launched a line of credit product to extend working capital loans to platform clients. With the $2 million round, Sokowatch—which currently operates in Kenya and Tanzania—plans to “expand to new markets in East Africa, as well as pilot additional value add services to the shops,” said Yu.

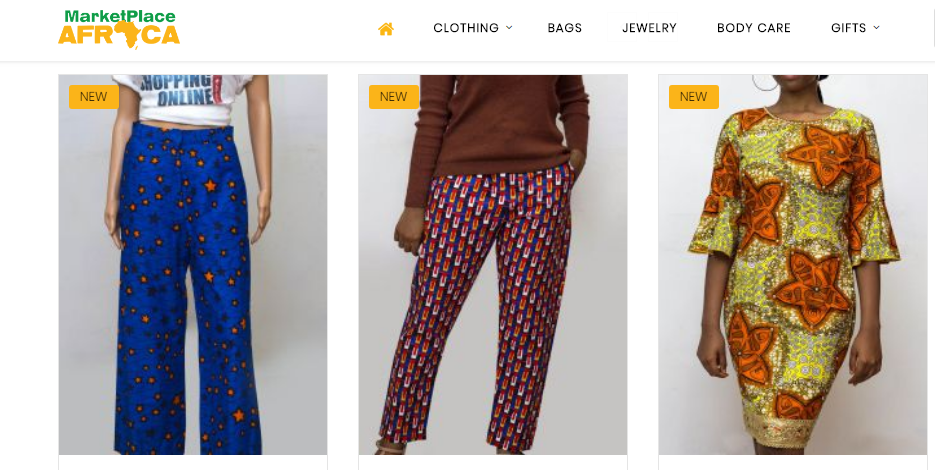

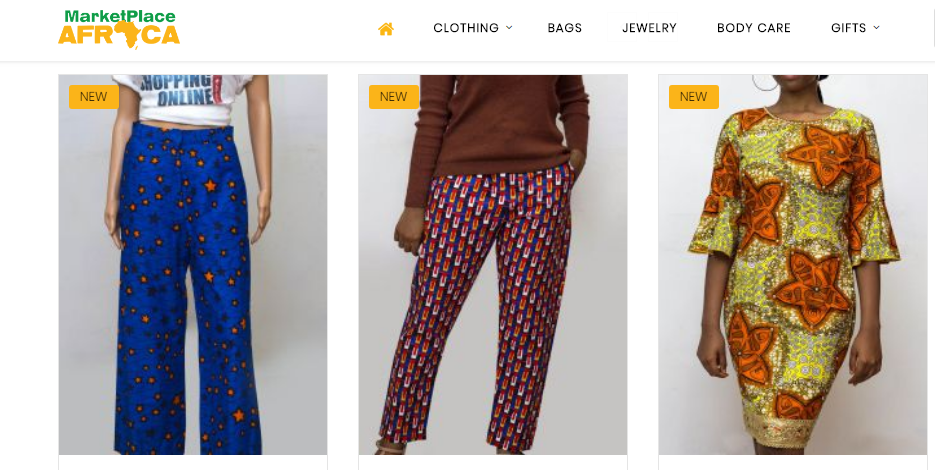

MallforAfrica and DHL launched MarketPlaceAfrica.com: a global e-commerce site for select African artisans to sell wares to buyers in any of DHL’s 220 delivery countries.

The site will prioritize fashion items — clothing, bags, jewelry, footwear and personal care — and crafts, such as pictures and carvings. MallforAfrica is vetting sellers for MarketPlace Africa online and through the Africa Made Product Standards association (AMPS), to verify made-in-Africa status and merchandise quality.

“We’re starting off in Nigeria and then we’ll open in Kenya, Rwanda and the rest of Africa, utilizing DHL’s massive network,” MallforAfrica CEO Chris Folayan told TechCrunch about where the goods will be sourced. “People all around the world can buy from African artisans online, that’s the goal,” Folayan told TechCrunch.

Current listed designer products include handbags from Chinwe Ezenwa and Tash women’s outfits by Tasha Goodwin.

In addition to DHL for shipping, MarketPlace Africa will utilize MallforAfrica’s e-commerce infrastructure. The startup was founded in 2011 to solve challenges global consumer goods companies face when entering Africa.

French President Emmanuel Macron href="https://pctechmag.com/2018/05/french-president-emmanuel-macron-launches-a-usd76m-africa-startup-fund/">unveiled a $76 million African startup fund at VivaTech 2018 and TechCrunch paid a visit to the French Development Agency (AFD) — who will administer the new fund — to get details on how it will work.

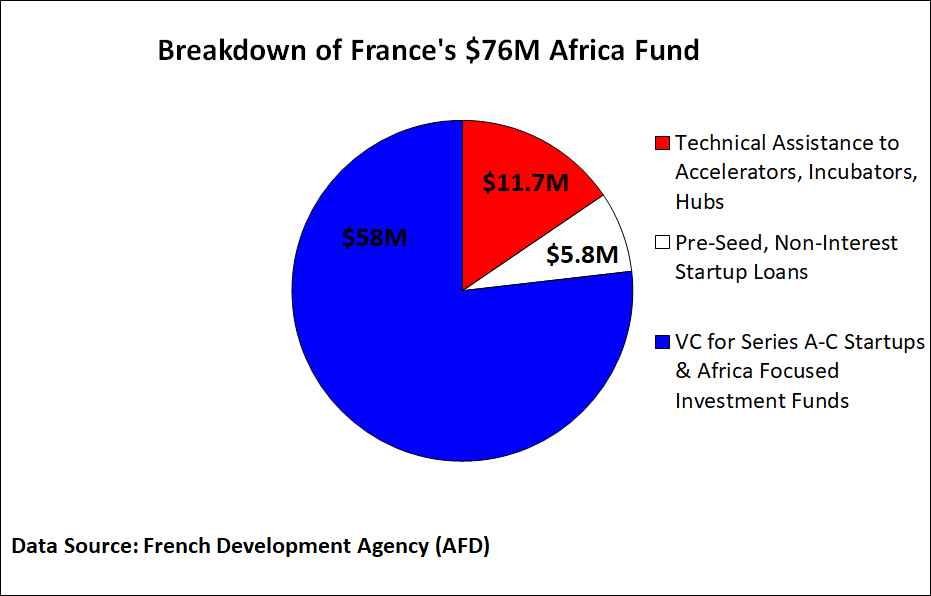

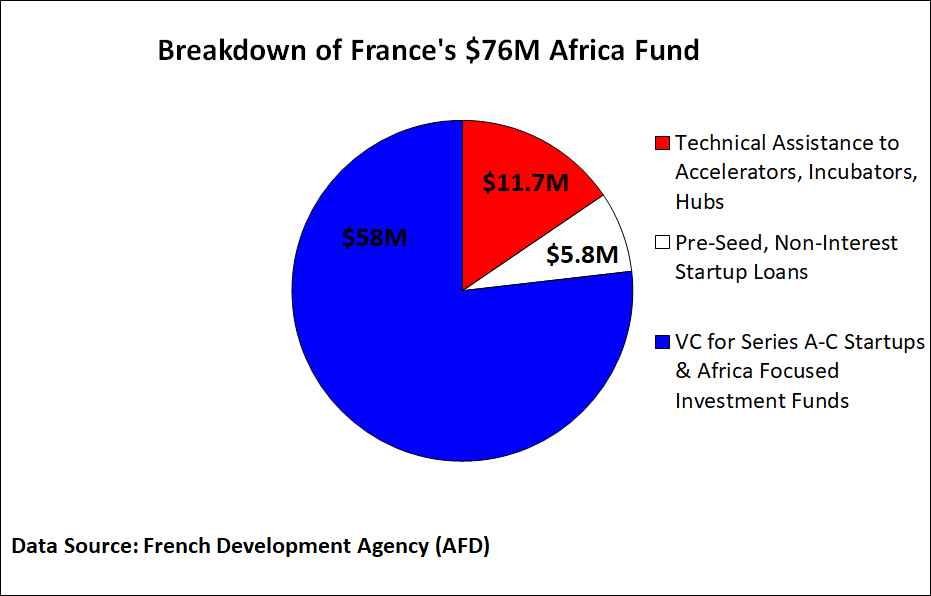

The $76 million (or €65 million) will divvy up into three parts, AFD Digital Task Team Leader Christine Ha told TechCrunch.

“There are €10 million [$11.7 million] for technical assistance to support the African ecosystem… €5 million will be available as interest-free loans to high-potential, pre-seed startups…and…€50 million [$58 million] will be for equity-based investments in series A to C startups,” explained Ha during a meeting in Paris.

The technical assistance will distribute in the form of grants to accelerators, hubs, incubators and coding programs. The pre-seed startup loans will issue in amounts up to $100,000 “as early, early funding to allow entrepreneurs to prototype, launch and experiment,” said Ha.

The $58 million in VC startup funding will be administered through Proparco, a development finance institution — or DFI — partially owned by the AFD. “Proparco will take equity stakes, and will be a limited partner when investing in VC funds,” said Ha.

Startups from all African countries can apply for a piece of the $58 million by contacting any of Proparco’s Africa offices.

The $11.7 million technical assistance and $5.8 million loan portions of France’s new fund will be available starting in 2019. On implementation, AFD is still “reviewing several options…such as relying on local actors through [France’s] Digital Africa platform,” said Ha. President Macron followed up the Africa fund announcement with a trip to Nigeria last month.

Nigerian logistics startup Kobo360 was accepted into Y Combinator’s 2018 class and gained some working capital in the form of $1.2 million in pre-seed funding led by Western Technology Investment.

The startup — with an Uber like app that connects Nigerian truckers to companies with freight needs — will use the funds to pay drivers online immediately after successful hauls.

Kobo360 is also launching the Kobo Wealth Investment Network, or KoboWIN — a crowd-invest, vehicle financing program. Through it, Kobo drivers can finance new trucks through citizen investors and pay them back directly (with interest) over a 60-month period.

On Kobo360’s utility, “We give drivers the demand and technology to power their businesses,” CEO Obi Ozor told TechCrunch. “An average trucker will make $3,500 a month with our app. That’s middle class territory in Nigeria.”

Kobo360 has served 324 businesses, aggregated a fleet of 5480 drivers and moved 37.6 million kilograms of cargo since 2017, per company stats. Top clients include Honeywell, Olam, Unilever, and DHL.

Ozor thinks the startup’s asset-free, digital platform and business model can outpace traditional long-haul 3PL providers in Nigeria by handling more volume at cheaper prices.

“Logistics in Nigeria have been priced based on the assumption drivers are going to run empty on the way back…When we now match freight with return trips, prices crash.”

Kobo360 will expand in Togo, Ghana, Cote D’Ivoire and Senegal.

[PHOTO: BFX.LAGOS] And finally, applications are open for TechCrunch’s Startup Battlefield Africa, to be held in Lagos, Nigeria, December 11. Early-stage African startups have until September 3 to apply here.

More Africa Related Stories @TechCrunch

More Africa Related Stories @TechCrunch

· CowryWise micro-savings service opens high-yield government bonds to everyday Nigerians

African Tech Around the Net

· More Than Half of Sub-Saharan Africa to Be Connected to Mobile by 2025, Finds New GSMA Study

· Ethiopia’s Gebeya acquires Coders4Africa to accelerate its growth

· Rwanda, Andela partner to launch pan-African tech hub in Kigali

· Google’s free public Wi-Fi initiative expanded to Africa

· Accounteer wins 2018 MEST Entrepreneur challenge

· SafeBoda completes expansion to Kenya, now live in Nairobi

· Uganda government sued over social media tax

from Android – TechCrunch https://ift.tt/2O9xDNw

via

IFTTT