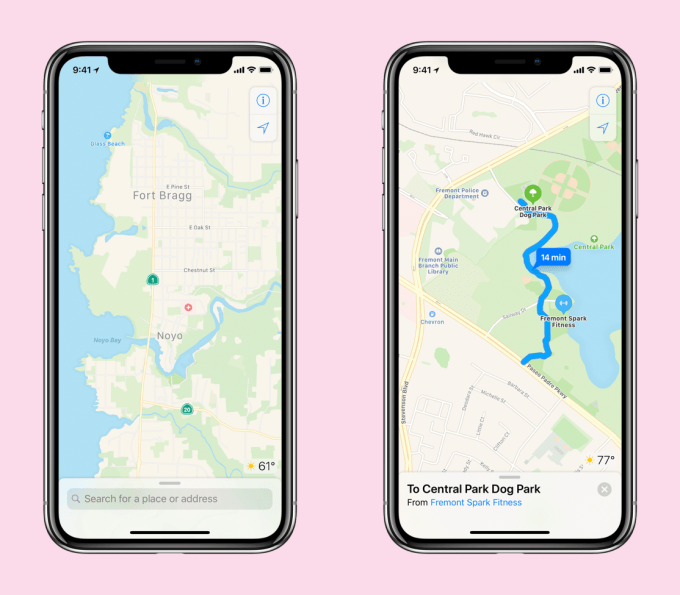

Apple’s updated and more detailed Maps experience has now rolled out across the U.S., the company announced this morning. The redesigned app will include more accurate information overall as well as comprehensive views of roads, buildings, parks, airports, malls, and other public places. It will also bring Look Around to more cities and real-time transit to Miami.

The company has now spent years upgrading its Maps experience to better compete with Google Maps, which Apple replaced with its own Maps app in 2012. That launch didn’t go well, to say the least. Apple CEO Tim Cook even had to apologize for how Maps fell short of customers’ expectations and promised Apple would do better going forward.

Over time, Apple has been making good on those promises, by updating Maps with better data and notably, by announcing a ground-up rebuild of the Maps platform back in 2018. Last year, Apple also introduced the new “Look Around” feature in iOS 13 — essentially Apple’s version of Google Street View, but one that uses high-resolution 3D views that offer more detail and smoother transitions.

iOS 13 also brought more Maps features, like real-time transit schedules, a list-making feature called Collections, Favorites, and more.

However, some of these Maps updates have been slow to roll out. Look Around, for example, has only been live in major cities including New York, the San Francisco Bay Area, L.A., Las Vegas, Houston, and Oahu. With the nationwide launch, it’s safe to assume you’re about to see it pop up in more major metros though Apple hasn’t provided names of which ones will get it first. Real-time transit information is offered only also in select major cities, including the San Francisco Bay Area, Washington D.C., New York, and Los Angeles.

Today, Apple is adding Miami to that list of supported cities offering real-time transit, just in time for Super Bowl weekend.

Over the course of 2019, Apple’s improved, more detailed Maps experienced has steadily expanded across the U.S., finally arriving in the North East as of last fall.

Today, the new Maps experience it’s starting to go live across all of the U.S. But that doesn’t necessarily mean you’ll see it right away when you launch the Maps app — the rollout is phased.

“We set out to create the best and most private maps app on the planet that is reflective of how people explore the world today,” said Eddy Cue, Apple’s senior vice president of Internet Software and Services, in a statement about the launch. “It is an effort we are deeply invested in and required that we rebuild the map from the ground up to reimagine how Maps enhances people’s lives — from navigating to work or school or planning an important vacation — all with privacy at its core. The completion of the new map in the United States and delivering new features like Look Around and Collections are important steps in bringing that vision to life. We look forward to bringing this new map to the rest of the world starting with Europe later this year,” he added.

The updated Apple Maps includes Look Around and real-time transit in some markets, Collections, Favorites, a Share ETA feature, flight status information for upcoming travel, indoor maps for malls and airports, Siri natural language guidance, and Flyover — a feature offering immersive, 3D views of major metros, as seen from above. The latter is available across over 350 cities.

Going forward, Apple will use the imagery it’s collect to deliver Look Around to more U.S. markets and begin to upgrade the Maps platform in Europe.

Maps’ biggest selling point today, however, may not be the sum of its feature sets. Instead, Maps’ standout feature is its focus on privacy.

While Google does use the data collected from Google Maps for many handy features — like reporting on a business’s busiest times, for example — it’s not a private app. In fact, it’s so not private that Google had to add an “incognito mode” as an option for users who didn’t want their Maps app collecting data on them.

Apple, meanwhile, notes that its app requires no-sign in, isn’t connected to your Apple ID, and its personalized features are implemented using on-device intelligence, not by sending data to cloud servers. In addition, any data collected when using Maps, like search terms, navigation routing, and traffic information, is only associated with random identifiers that continually reset to protect user privacy.

Apple also uses a process called “fuzzing” that converts a precise location where a Maps search originated to a less precise one after 24 hours. And it doesn’t retain a history of what a user has searched for or where they’ve been.

In an era where people assume, usually correctly, that the mere act of launching an app is an agreement to have their data collected, Apple’s increased emphasis on user privacy is welcome and a good reason to try Apple Maps again, if you never came back to it after the shaky launch.

Apple Maps, now used in over 200 countries, is available on iPhone, iPad, Mac, Apple Watch and in cars via CarPlay.

from Apple – TechCrunch https://ift.tt/36HHfYx