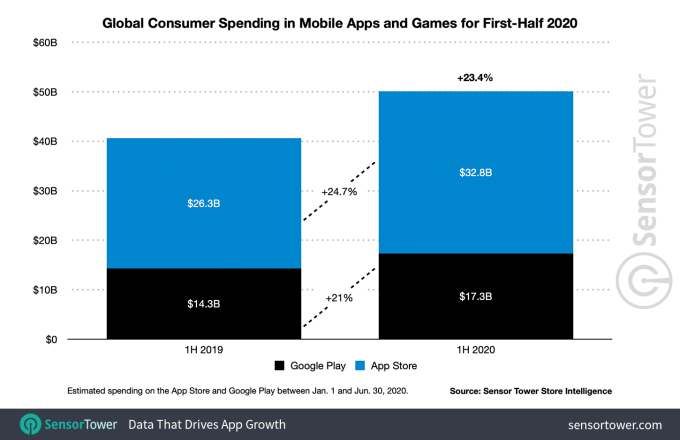

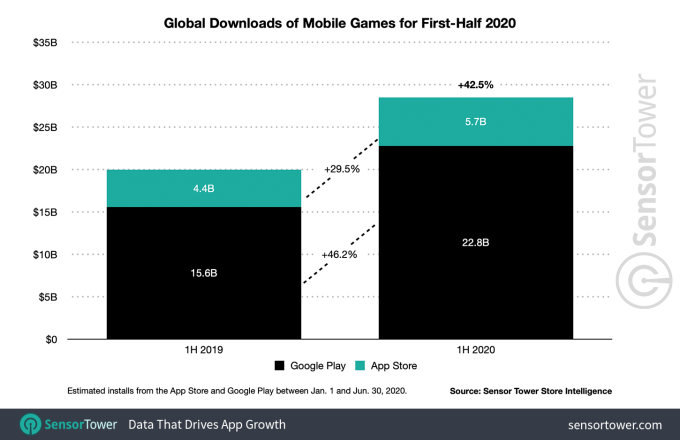

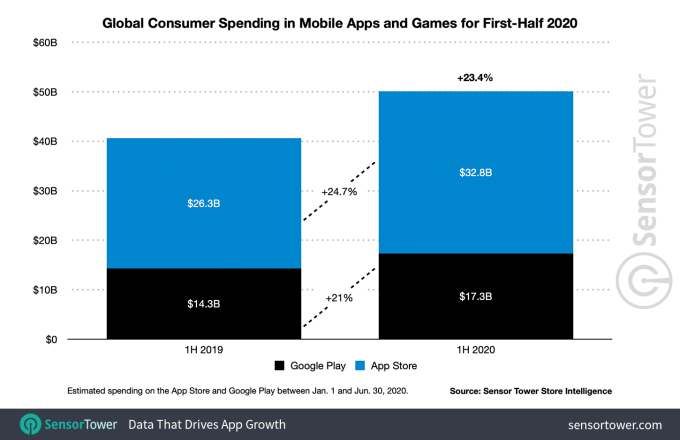

Consumer spending on mobile apps and app installs grew significantly during the first half of 2020, in part due to the COVID-19 pandemic, according to new data from Sensor Tower. In the first half of the year, consumers spent $50.1 billion worldwide across the App Store and Google Play — a figure that’s up 23.4% from the first half of 2019. Previously, revenue had grown 20% between the first half of 2018 and 2019, for comparison. In addition, first-time app installs were up 26.1% year-over-year in the first half of 2020 to reach 71.5 billion downloads.

Apple’s App Store accounted for 18.3 billion of those downloads, up 22.8% year-over-year, while Google Play delivered 53.2 billion new app installs, up 27.3%.

Image Credits: Sensor Tower

Though Google Play saw far more app installs, Apple’s App Store continued to outpace its rival on consumer spending.

During the first half of the year, the App Store generated $32.8 billion from in-app purchases, subscriptions, and premium apps and games, Sensor Tower estimates. This figure is up 24.7% year-over-year from the $26.3 billion spent during the first half of 2019. It’s also nearly twice the estimated gross revenue on Google Play, which was $17.3 billion, an increase of 21% year-over-year.

Image Credits: Sensor Tower

The pandemic’s impacts are only somewhat reflected in the top-earning (non-game) apps of the first half of 2020. The biggest earner, for example, was Match’s online dating app Tinder — an app that, one would think, would have dropped out of the top 5 due to social distancing requirements.

During the first half of the year, Tinder generated an estimated $433 million in spending across both app stores, combined. However, this number does represent a decrease of about 19% from the first half of 2019, or $532 million. It’s unclear how much that decline is related to consumers’ changing behavior and spending habits during the pandemic. Though shelter-in-place orders and quarantines kept people indoors and social distancing, social networking apps — and particularly those focused on online communication — have boomed amid lockdowns.

Image Credits: Sensor Tower

Tinder embraced the growing interest in online networking by making its “Passport” feature free. This setting allows users to match with other singles around the world, turning Tinder into more of a social app than one focused on real-world dating. But this change could have also led to a decrease in Tinder’s total revenues for the first half of the year.

The No. 2 top grossing app during the first half of 2020 was YouTube, bringing in an estimated $431 million globally. This was followed by ByteDance’s TikTok with $421 million. The social video app, which includes Douyin in China, had also broken download records during the first half of the year, passing 2 billion total global downloads, Sensor Tower earlier reported.

Tencent Video and Netflix were the No. 4 and No. 5 top grossing apps, respectively.

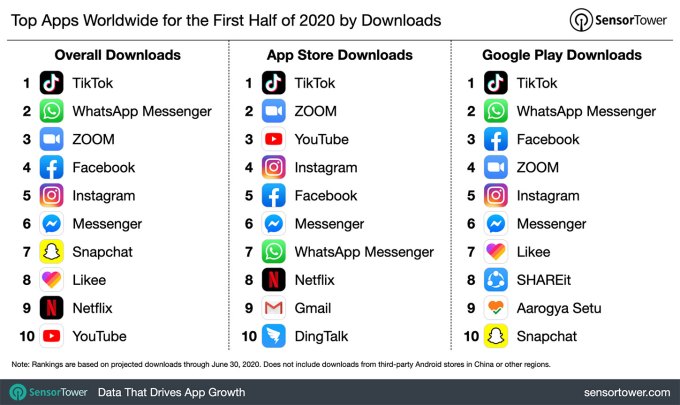

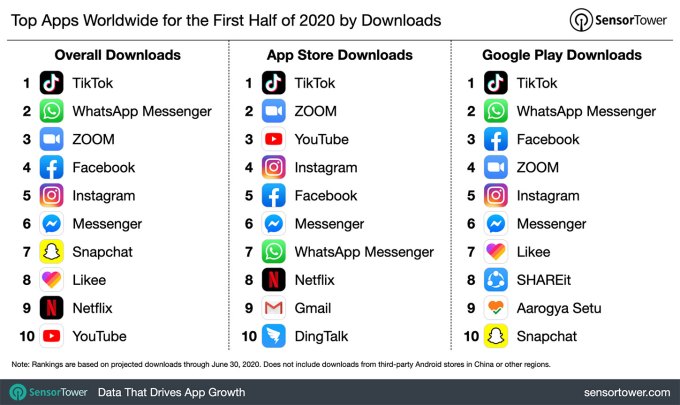

Meanwhile, consumers stuck at home during the pandemic have been downloading apps and games in greater numbers. During the first half of the year, consumers installed 71.5 billion apps for the first time, up 26.1% from the first half of 2019.

Image Credits: Sensor Tower

TikTok was the most-downloaded app in the first half of the year with 626 million downloads. But its position may look quite different in the second half of year, given the recent changes in India where the government has now banned 59 Chinese apps, including TikTok.

The No. 2 and No. 3 apps were WhatsApp and Zoom, respectively — the latter an indication of the rapid shift to work-from-home and consumers’ embrace of online video conferencing, in general. In addition to WhatsApp, Facebook snagged the No. 4, No. 5, and No. 6 positions in the top 10, with Facebook, Instagram and Messenger, in that order.

Snapchat’s social app was No. 7 and No. 8 was video app Likee, which is similar to TikTok but offers a variety of face effects and filters. Netflix and YouTube rounded out the top 10.

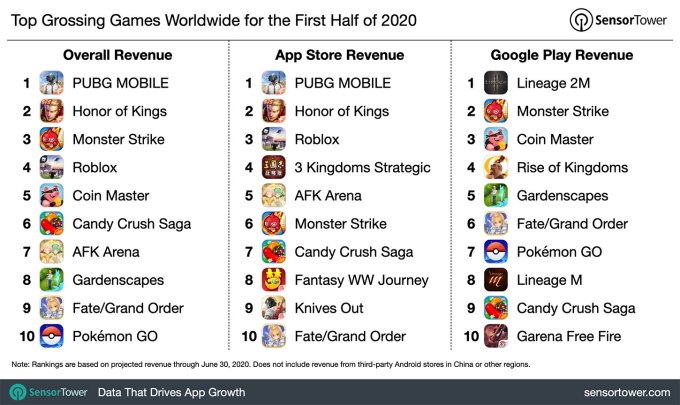

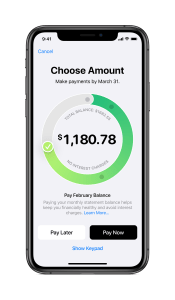

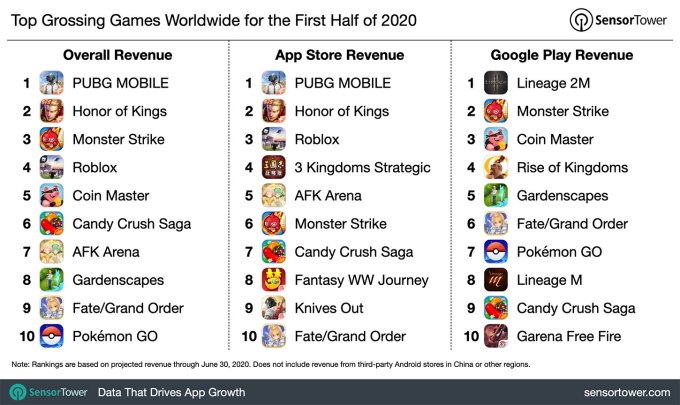

Mobile gaming also saw a boost during the pandemic, with game spending up 21.2% year-over-year to reach an estimated $36.6 billion during the first half of the year, Sensor Tower found. Spending on the App Store grew 22.7% year-over-year to reach $22.2 billion, while Google Play game spending grew 19% to reach $14.4 billion.

Image Credits: Sensor Tower

Tencent’s PUBG Mobile beat out Honor of Kings as the top-grossing game for the first half of the year. Tencent’s game, which includes its localized versions (Game for Peace and Peacekeeper Elite) generated $1.3 billion across both app stores, not including China’s third-party Android app stores. Honor of Kings, meanwhile, pulled in roughly $1 billion.

The remaining top 10 included, in order, Monster Strike ($632M), Roblox, Coin Master, Candy Crush Saga, AFK Arena, Gardenscapes, Fate/Grand Order, and Pokémon Go. The latter recently adapted to indoor gaming amid government lockdowns.

Roblox, in particular, has been surging due to the pandemic as kids stuck indoors have gone online to play and socialize with friends in its virtual environment. In June, Sensor Tower reported Roblox had surpassed a milestone of $1.5 billion in lifetime player spending, for instance. Coin Master, meanwhile, is approaching the $1 billion lifetime player milestone, the firm found.

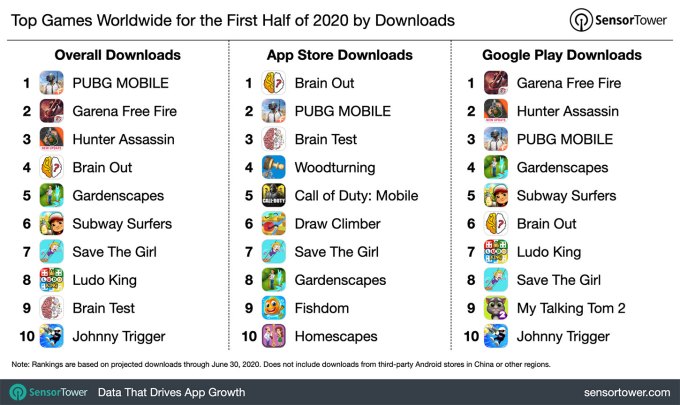

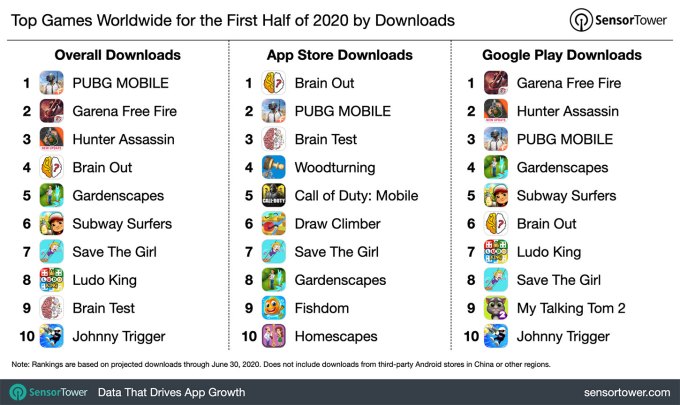

In terms of top game installs, PUBG Mobile came out on top here as well, followed by another battle royale title, Garena Free Fire. Ruby Game Studio’s Hunter Assassin, Eyewind Limited’s Brain Out, and Playrix’s Gardenscapes — which many found to be a relaxing distraction during a stressful time — rounded out the top five.

Image Credits: Sensor Tower

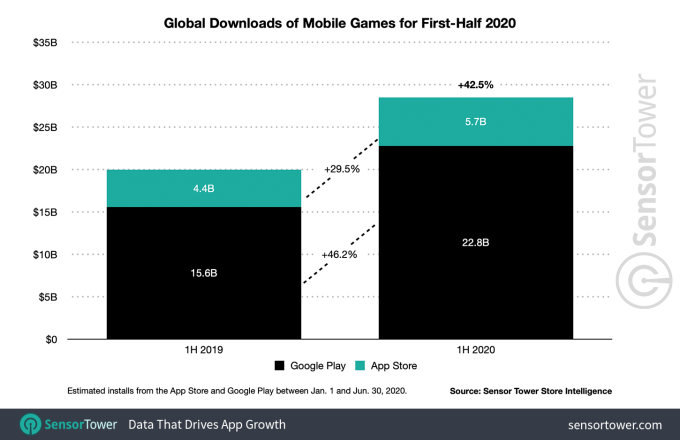

Across all of the mobile gaming market, downloads grew 42.5% year-over-year to reach 28.5 billion first-time installs in the first half of 2020. Of those, Google Play downloads grew 46.2% year-over-year to 22.8 billion while App Store downloads grew 29.5% to 5.7 billion.

Image Credits: Sensor Tower

COVID-19 impacts more apparent in Q2

Indications of COVID-19’s impact on the app market can be found among the figures for the first half of the year — like the growth seen by Zoom or social gaming platforms like Roblox, for example. But a closer look at the second quarter of 2020 alone makes the COVID-19 impacts more apparent.

Sensor Tower’s initial projections show consumer spending on apps and games jumped 11% on a quarterly basis from Q1 to Q2, and grew 28.8% year-over-year to reach $26.4 billion worldwide. This is a sizable increase from the 1.4% growth between Q1 2019 and Q2 2019. Downloads were up 12% on a quarterly basis and up 31.7% year-over-year to reach 37.8 billion worldwide. Again, a large increase from the 2.5% growth between Q1 2019 and Q2 2020.

from Apple – TechCrunch https://ift.tt/2Af3BGy