In this blog you can visit new technology latest news about advance technology viral news latest andriod phones and much more visit this blog for more updates daily thanks

Sunday, 7 October 2018

Friday, 5 October 2018

How the 22-year-old founders of Brex built a billion-dollar business in less than 2 years

When Brazilian-born Henrique Dubugras and Pedro Franceschi met at 16 years old, they bonded over a love of coding and mutual frustrations with their strict mothers, who didn’t understand their Mark Zuckerberg-esque ambitions.

To be fair, their moms’ fear of their hacking habits only escalated after their pre-teen sons received legal notices of patent infringements in the mail. A legal threat from Apple, which Franceschi received after discovering the first jailbreak to the iPhone, is enough to warrant a grounding, at the very least.

Their parents implored them to quit the hacking and stop messing around online.

They didn’t listen.

Today, the now 22-year-olds are announcing a $125 million Series C for their second successful payments business, called Brex, at a $1.1 billion valuation. Greenoaks Capital, DST Global and IVP led the round, which brings their total raised to date to about $200 million.

San Francisco-based Brex provides startup founders access to corporate credit cards without a personal guarantee or deposit. It’s also supported by the likes of PayPal founders Peter Thiel and Max Levchin, the former chief executive officer of Visa Carl Pascarella and a handful of leading venture capital firms.

“Brex is off to one of the most exciting starts we’ve ever seen,” IVP’s Somesh Dash said in a statement.

The financing makes them some of the youngest unicorn founders in history and puts them in a rare class of startups that have galloped into unicorn territory at such a fast clip. Brex was founded in the winter of 2017. It only launched publicly in June 2018.

How’d they do it?

“I’ve had two failed attempts, one successful attempt and one on the way to being a successful attempt,” Brex CEO Dubugras told TechCrunch while reciting a lengthy resume.

At 14, when most of us were worrying about what the first year of high school would bring us, Dubugras was more concerned about what his next business attempt would be. He had already built a successful online game but was forced to shut it down after receiving those patent infringement notices.

Naturally, he used the cash he earned from the game to start a company — an education startup meant to help Brazilian students apply to American schools. He himself was hoping to get into Stanford and had learned quickly how little Brazilian students understood of the U.S. college application process.

In some respects, the company was a success. It garnered 800,000 users but failed to make any money. His small fortune wasn’t enough to scale the business.

“There aren’t a lot of VCs in Brazil that are willing to fund 15-year-olds,” Dubugras told TechCrunch.

Shortly after folding the edtech, he met Franceschi, a Brazilian teen from Rio — Dubugras is from São Paulo — who understood his appetite for innovation and was just as hungry for success. The pair got to talking and because of Franceschi’s interest in payments, they started Pagar.me, the “Stripe of Brazil.”

Pagar.me raised $30 million, amassed a staff of 100 and was processing up to $1.5 billion in transactions when it sold. Finally, they had a real success under their belt. Now it was time to relocate.

“We wanted to come to Silicon Valley to build stuff because everything here seemed so big and so cool,” Dubugras said.

And come to Silicon Valley they did. In the fall of 2016, the pair enrolled at Stanford. Shortly after that, they entered Y Combinator with big dreams for a virtual reality startup called Beyond.

“I think three weeks in we gave it up,” Dubugras said. “We realized we aren’t the right founders to start this business.”

He credits Y Combinator with helping him realize what they were good at — payments.

As founders themselves, Dubugras and Franceschi were hyper-aware of a huge problem entrepreneurs face: access to credit. Big banks see small businesses as a risk they aren’t willing to take, so founders are often left at a dead-end. Dubugras and Franceschi not only had a big network of startup entrepreneurs in their Rolodex, but they had the fintech acumen necessary to build a credit card business designed specifically for founders.

So, they scrapped Beyond and in April 2017, Brex was born. The startup picked up momentum quickly, so much so that the pair decided to drop out of Stanford and pursue the business full time.

Simplifying financial access

Brex doesn’t require any kind of personal guarantee or security deposit and it doesn’t use third-party legacy technology; its software platform is built from scratch.

It simplifies a lot of the frustrating parts of corporate expenses by providing companies with a consolidated look at their spending. At the end of each month, for example, a CEO can easily see how much the entire company spent on Uber or Amazon.

Plus, Brex can give entrepreneurs a credit limit that’s as much as 10 times higher than what they’d receive elsewhere and they can issue cards, virtual cards at least, moments after the online application is complete.

“We have a very similar effect of what Stripe had in the beginning, but much faster because Silicon Valley companies are very good at spending money but making money is harder,” Dubugras explained.

As part of their funding announcement, Brex said it will launch a rewards program built with the needs and spending patterns of founders in mind. Beyond that, they plan to use the capital to hire engineers and figure out how to grow the business’s client base beyond only tech startups.

“We want to dominate corporate credit cards,” Dubugras said. “We want every single company in the world, whenever they do businesses expenses, to do it on a Brex card.”

from Apple – TechCrunch https://ift.tt/2yhTgok

We’re talking AR with Snap’s camera platform head at TC Sessions: AR/VR

For a lot of consumers, Pokemon Go wasn’t their first exposure to augmented reality, it was the dog selfie lens inside Snapchat.

In the past few years, consumer use hasn’t evolved too heavily when it comes to what people are actually using AR for even though technical capabilities have taken some giant leaps. Snap was an early leader but now the industry is much more crowded with Apple, Google, Facebook and others all staffing up extensive teams focused on smartphone-based AR capabilities.

At our one-day TC Sessions: AR/VR event in LA on October 18, we’ll be chatting with Eitan Pilipski, the VP of Snap’s Camera Platform, a role that would seem to be pretty central to the long-term vision of a company that has long referred to itself as “a camera company.”

Snap has been throwing some updates to their developer tools as of late especially for their Lens Studio product which gives developers access to tools to create AR masks and experiences. There’s a lot of room to grow, and it will be interesting to see how much depth Snap can pull from these short experiences and whether it sees “lenses” evolving to bring users more straight-forward utility in the near-term.

The company hasn’t had the easiest bout as a public company lately, but it’s clear that it sees computer vision and augmented reality as key parts of the larger vision it hopes to achieve. At our LA event we’ll look to dive deeper into how they’re approaching these technologies and what it can bring consumers beyond a little added enjoyment.

As a special offer to TechCrunch readers, save 35% on $149 General Admission tickets when you use this link or code TCFAN. Student tickets are just $45 and can be booked here.

from Apple – TechCrunch https://ift.tt/2E1P9D4

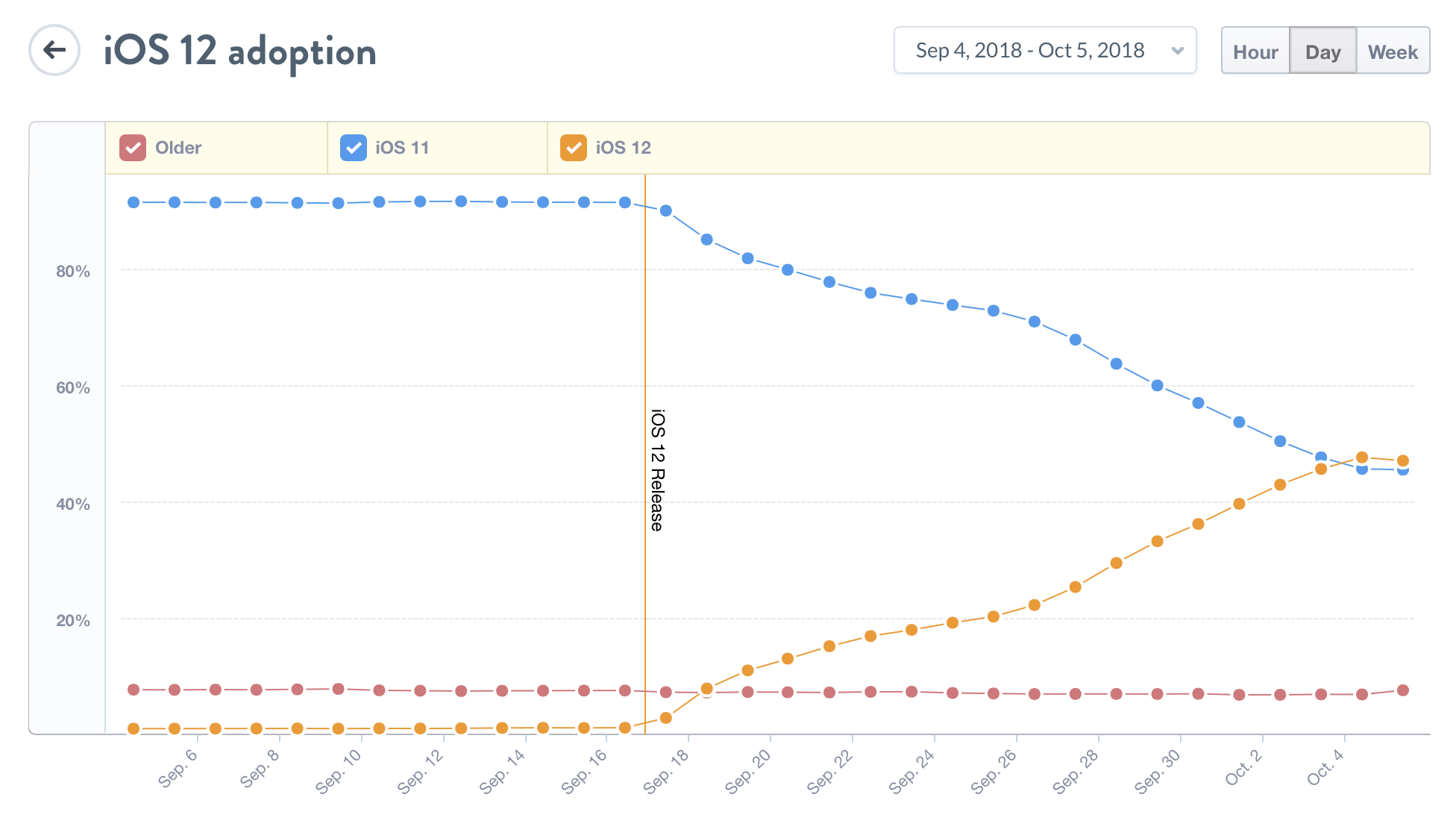

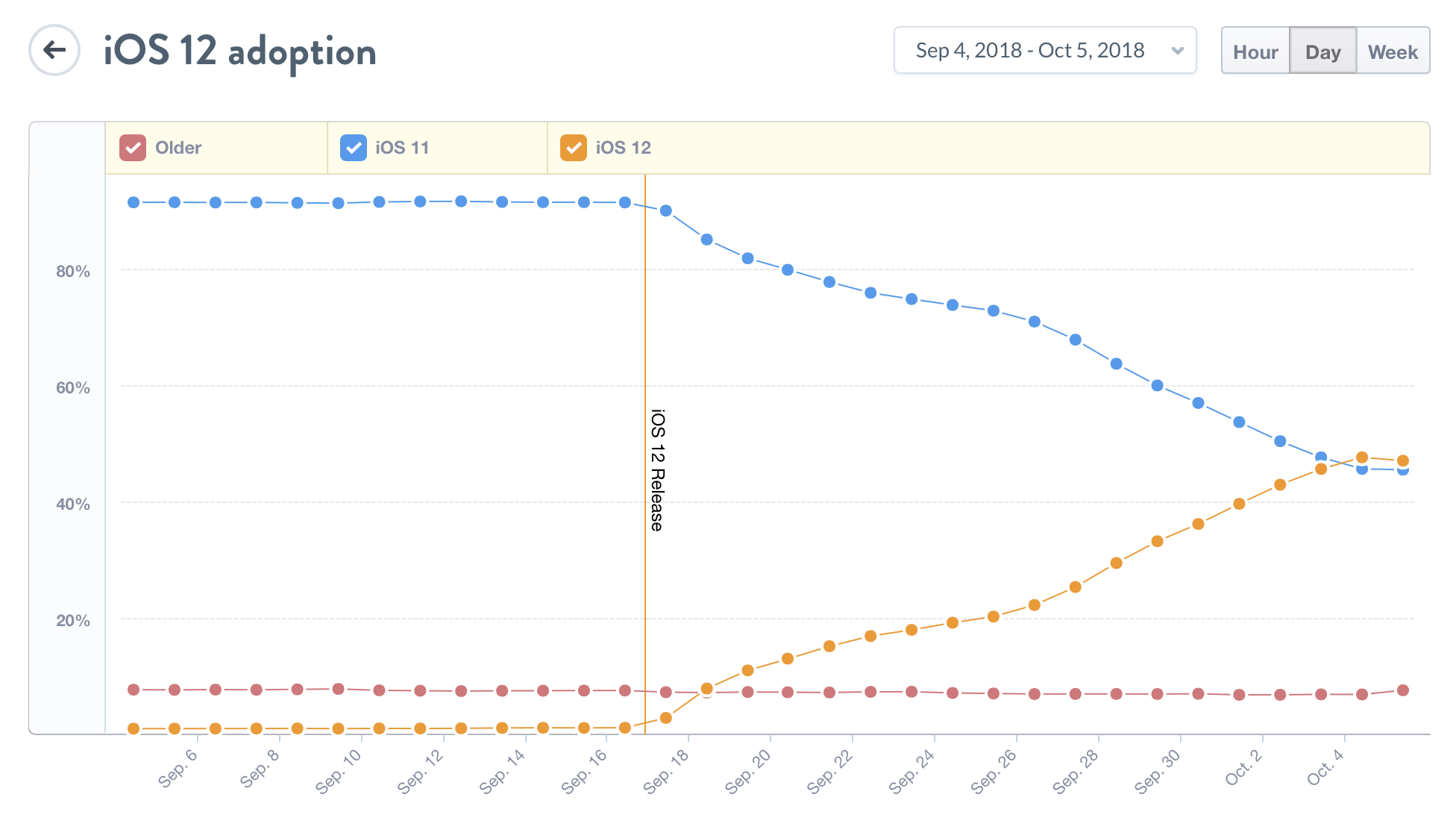

Most iOS devices now run iOS 12 according to Mixpanel’s data

Analytics company Mixpanel is currently tracking the install base of iOS 12. And the latest version of iOS is quite popular as it’s already installed on roughly 47.6 percent of all iOS devices. 45.6 percent of devices still run iOS 11, and 6.9 percent of iOS users run an older version.

Adoption rate is an important metric for app developers. With major iOS releases, Apple also releases new frameworks. But developers still need to support old versions of iOS for a little bit before moving entirely to newer frameworks and drop support for old iOS versions.

But it’s interesting to see that you can already drop support for iOS 10 without losing too many customers. Chances are that users who don’t update their version of iOS don’t really care about having the latest version of your app anyway.

With iOS 11, it took much longer to reach that level. Last year, Apple announced on November 6th that iOS 11 was more popular than iOS 10. Sure, Mixpanel and Apple don’t have the exact same numbers, but you can already see that the trend is different this year.

iOS 12 focuses on performance. Apple has optimized this major release for older devices, such as the iPhone 6. All devices that run iOS 11 can update to iOS 12 as well. Basically, if you want a faster phone, you should update to iOS 12.

This is a bit counterintuitive as previous iOS releases had rendered older devices much slower. But it sounds like iOS users got the message based on the adoption rate.

from iPhone – TechCrunch https://ift.tt/2y1f0FO

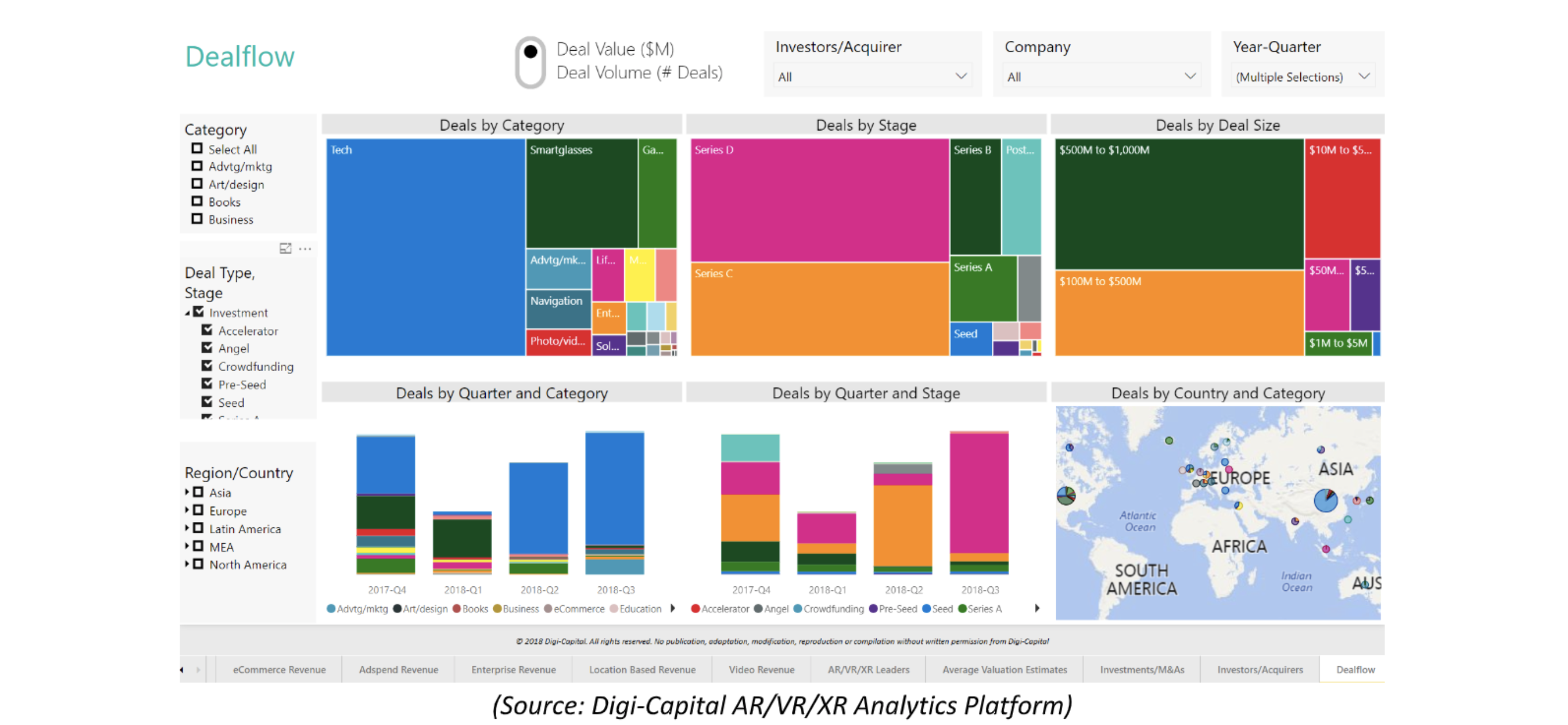

Chinese investment into computer vision technology and AR surges as U.S. funding dries up

Last year 30 leading venture investors told us about a fundamental shift from early stage North American VR investment to later stage Chinese computer vision/AR investment — but they didn’t anticipate its ferocity.

Digi-Capital’s AR/VR/XR Analytics Platform showed Chinese investments into computer vision and augmented reality technologies surging to $3.9 billion in the last 12 months, while North American augmented and virtual reality investment fell from nearly $1.5 billion in the fourth quarter of 2017 to less than $120 million in the third quarter of 2018. At the same time, VC sentiment on virtual reality softened significantly.

What a difference a year makes.

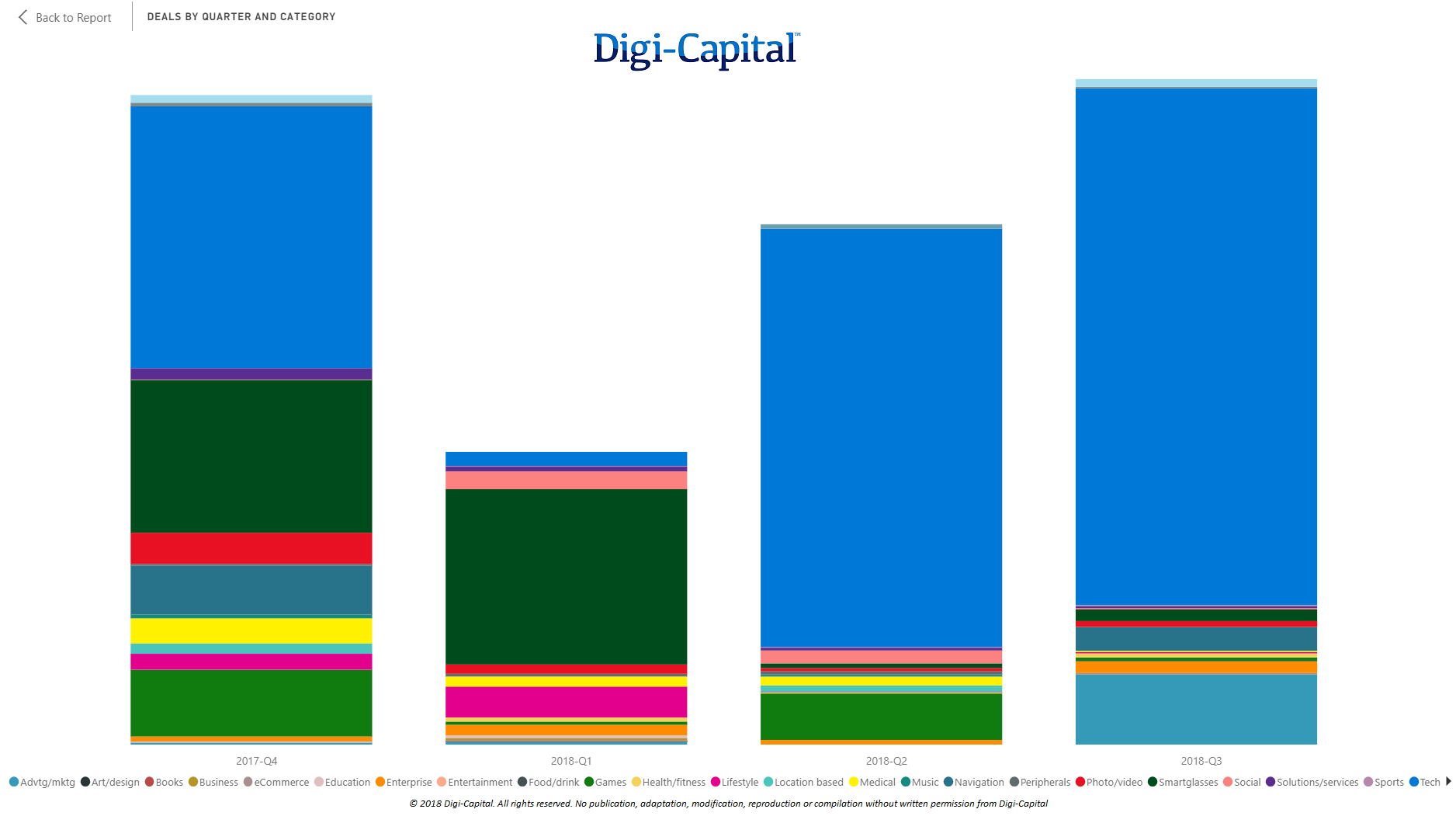

Dealflow (dollars)

What VCs said a year ago

When we spoke to venture capitalists least year, they had some pretty strong opinions.

Mobile augmented reality and Computer Vision/Machine Learning (“CV/ML”) are at opposite ends of the spectrum — one delivering new user experiences and user interfaces and the other powering a broad range of new applications (not just mobile augmented reality).

The market for mobile AR is very early stage, and could see $50 to $100 million exits in 2018/2019. Dominant companies will take time to emerge, and it will also take time for developers to learn what works and for consumers and businesses to adopt mobile AR at scale (note: Digi-Capital’s base case is mobile AR revenue won’t really take off until 2019, despite 900 million installed base by Q4 2018). Tech investors are most interested in native mobile AR with critical use cases, not ports from other platforms.

Computer vision and visual machine learning is more advanced than mobile AR, and could see dominant companies in the near-term. Here, investors love startups with real-world solutions that are challenging established industries and business practices, not research projects. Firms are investing in more than 20 different mobile augmented reality and computer vision and visual machine learning sectors, but there is the potential for overfunding during the earliest stages of the market.

What VCs did in the last 12 months

Perhaps the most crucial observation is the declining deal volumes over the last year.

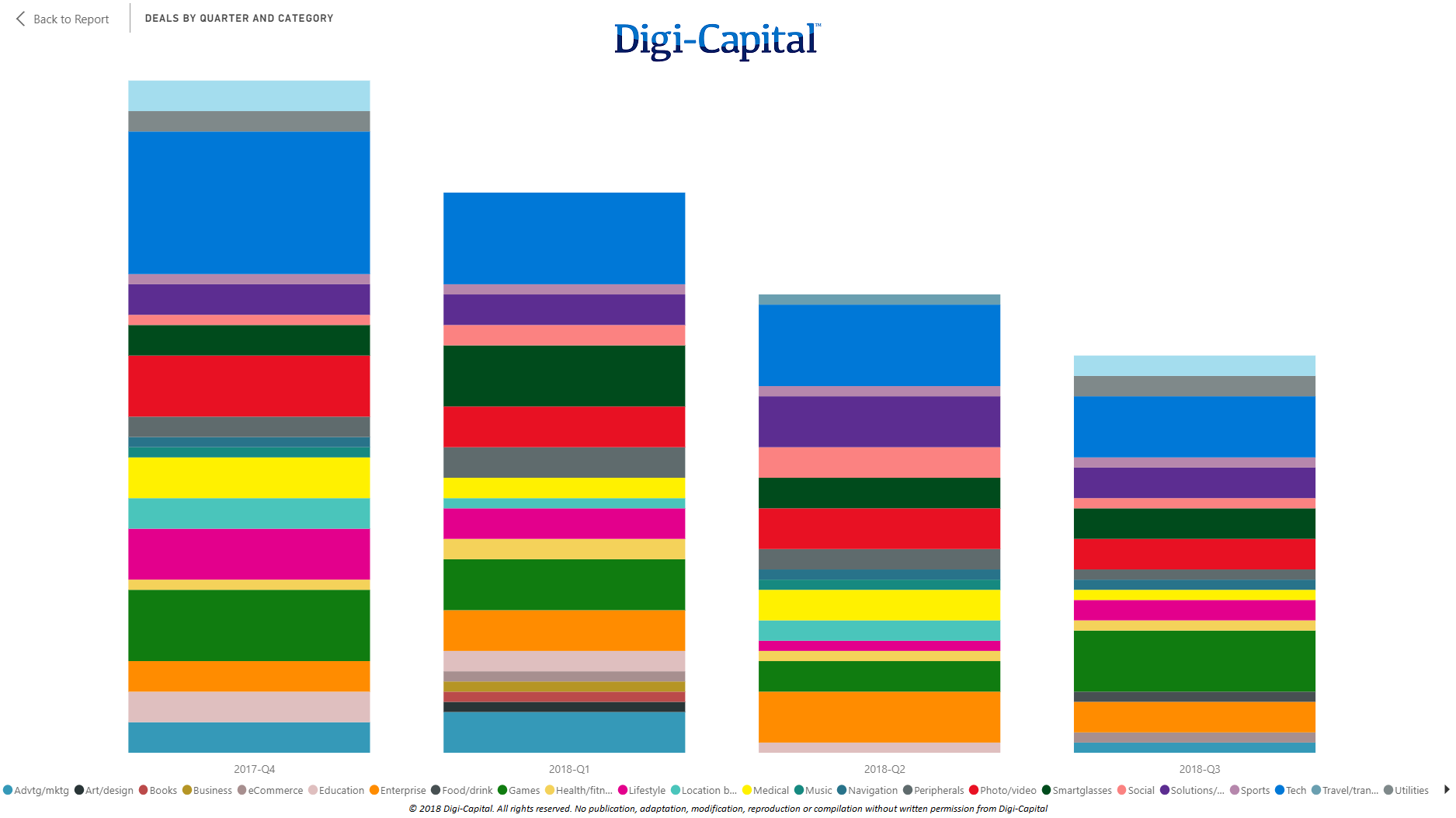

Deal Volume (number of deals by category)

(Source: Digi-Capital AR/VR/XR Analytics Platform)

Deal volume (the number of deals) declined steadily by 10% per quarter over the last 12 months, and was around two-thirds the level in Q3 2018 that it was in Q4 2017. Most of the decline happened in the US and Europe, where VCs increasingly stayed on the sidelines by looking for short-term traction as a sign of long-term growth. (Note: data normalized excluding HTC ViveX accelerator Q4 2017, which skews the data)

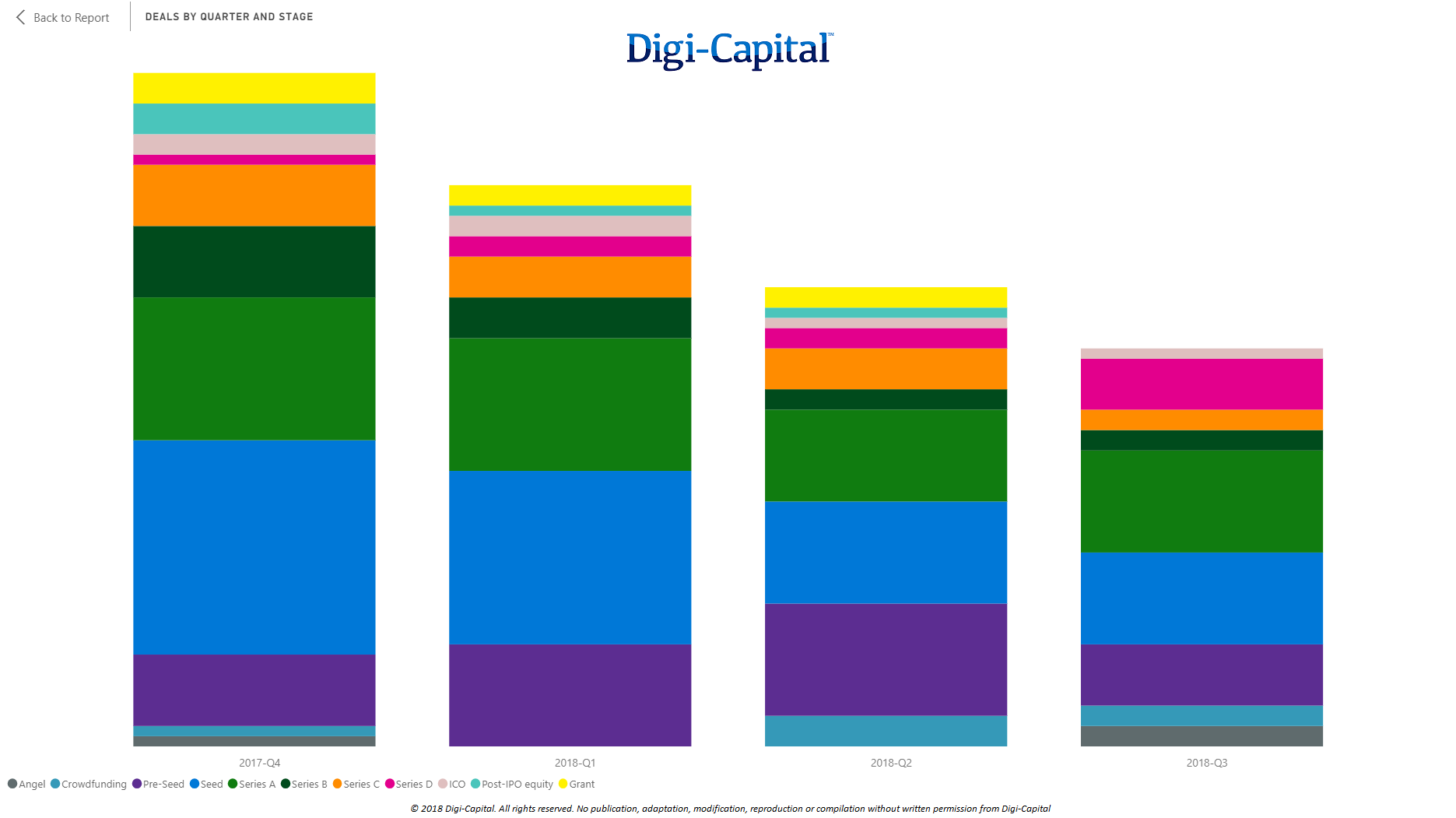

Deal Volume (number of deals by stage)

The biggest casualties of this short-termist approach have been early stage startups raising seed (deal volume down by more than half) and some series A (deal volume down by a quarter) rounds. This trend has been strongest in North America and Europe, but even Asia has not been entirely immune from some early stage deal volume decline.

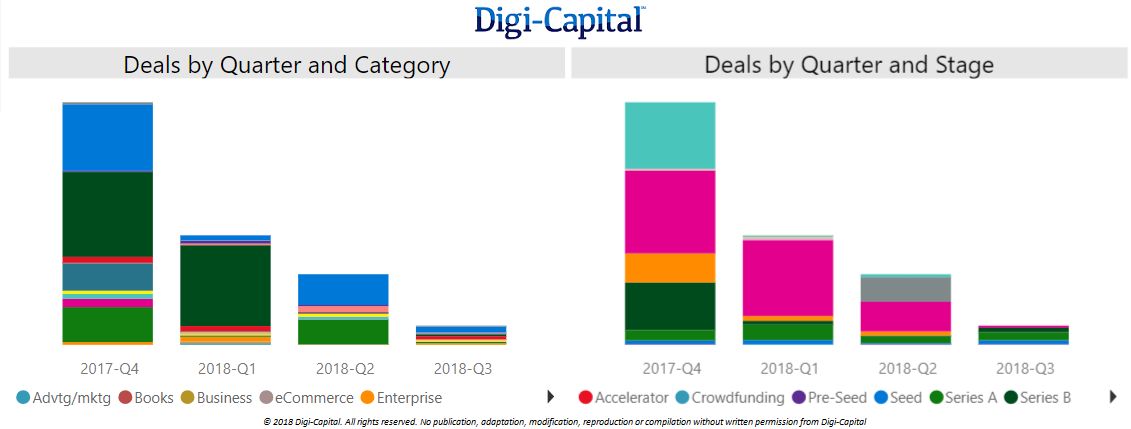

Deal Value (dollars)

(Source: Digi-Capital AR/VR/XR Analytics Platform)

While deal volume is a great indicator of early-stage investment market trends, deal value (dollars invested) gives a clearer picture of where the big money has been going over the last 12 months. (Note: investment means new VC money into startups, not internal corporate investment – which is a cost). Global investment hit its previous quarterly record over $2 billion in Q4 2017, driven by a few very large deals. It then dropped back to around $1 billion in the first quarter of this year. Since then deal value has steadily climbed quarter-on-quarter, to reach a new record high well over $2 billion in Q3 2018.

Over $4 billion of the total $7.2 billion in the last 12 months was invested in computer vision/AR tech, with well over $1 billion going into smartglasses (the bulk of that into Magic Leap). The next largest sectors were games around $400 million and advertising/marketing at a quarter of a billion dollars. The remaining 22 industry sectors raised in the low hundreds of millions of dollars down to single digit millions in the last 12 months.

A tale of two markets

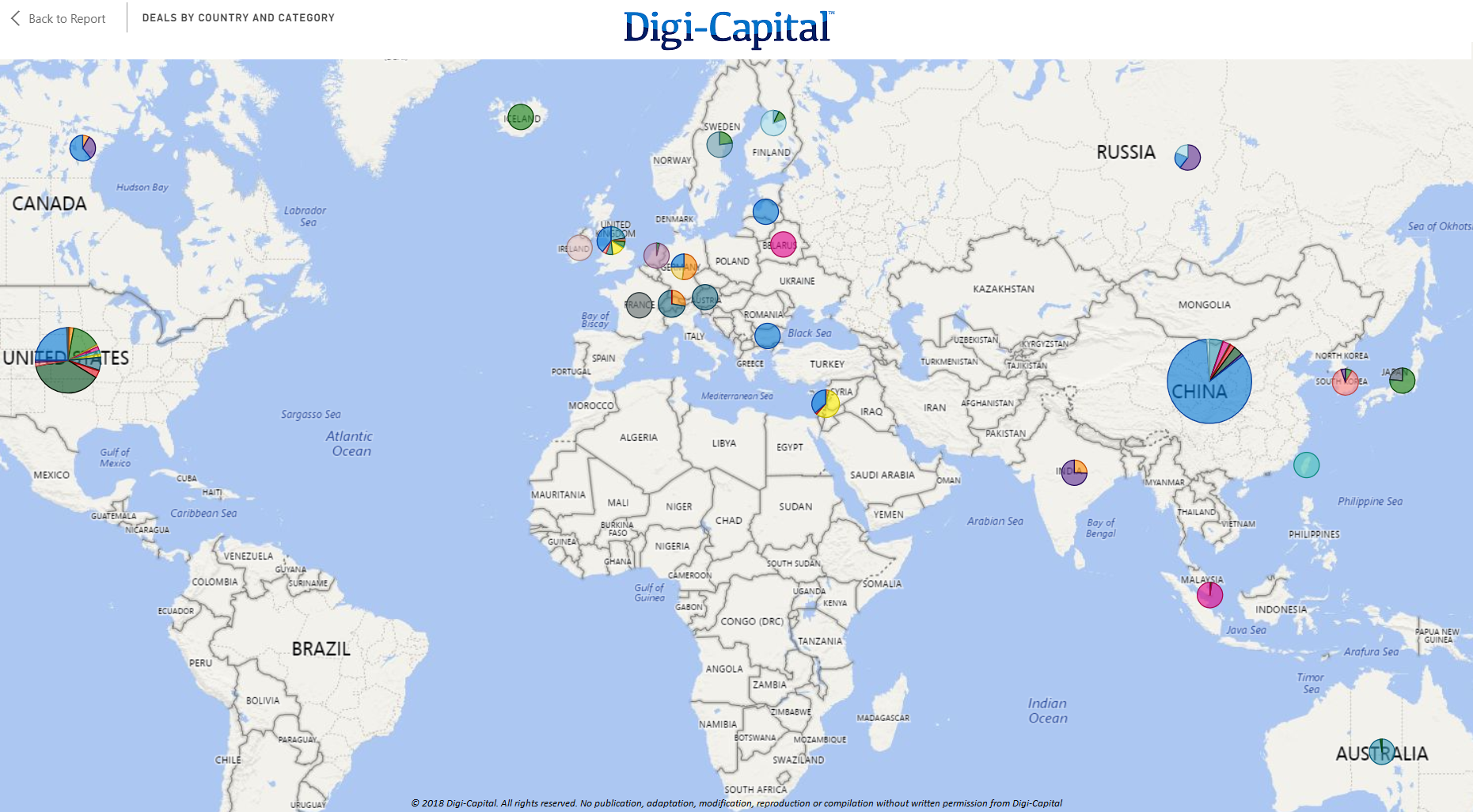

Deals by Country and Category (dollars)

American and Chinese investment had an inverse relationship in the last 12 months. American investors increasingly chose to stay on the sidelines, while Chinese investor confidence grew to back up clear vision with long-term investments. The differences in the data couldn’t be more stark.

North American Deals (dollars)

North American investment was almost triple Asian investment in Q4 2017, with a record high of nearly $1.5 billion dollars for the quarter. Despite 2018 being a transitional year for the market (Digi-Capital forecast that market revenue was unlikely to accelerate until 2019), North American quarterly investment fell over 90% to less than $120 million in Q3 2018. American VCs appear to have taken a long-term solution to a short-term problem.

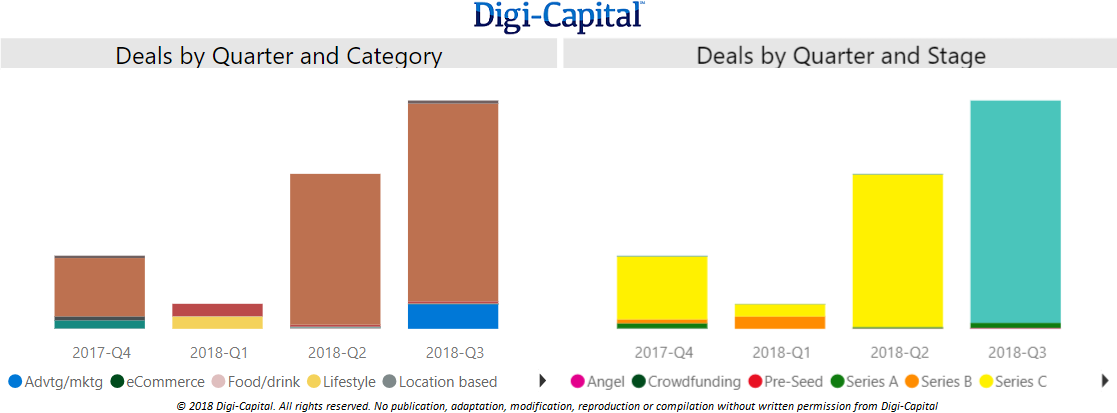

China Deals (dollars)

Meanwhile, Chinese VCs have been focused on the long-term potential of the intersection between computer vision and augmented reality, with later-stage Series C and Series D rounds raising hundreds of millions of dollars a time. This trend increased dramatically in the last 12 months, with SenseTime Group raising over $2 billion in multiple rounds and Megvii close behind at over $1 billion (also multiple rounds).

Smaller investments (by Chinese standards) in the hundreds of millions have gone into companies Westerners might not know, including Beijing Moviebook Technology, Kujiale and more. All this saw Chinese quarterly investment grow 3x in the last 12 months. (Note: some recent Western opinions about market investment trends were based on incomplete data)

Where to from here?

With our team’s investment banking background, experience shows that forecasting venture capital investment is a fool’s errand. Yet it is equally foolish to ignore hard data, and ongoing discussions with leading investors along Sand Hill Road and China indicate some trends to watch.

American tech investors might continue to wait for market traction before providing the fuel needed for that traction (even if that seems counterintuitive). While this could pose an existential threat to some early stage startups in North America, it’s also an opportunity for smart money with longer time horizons.

Conversely, Chinese VCs continue to back domestic companies which could dominate the future of computer vision/augmented reality. The next 6 months will determine if this is a long-term trend, but it is the current mental model.

If mobile AR revenue accelerates in 2019 as critical use cases and apps emerge (as in Digi-Capital’s base case), this could become a catalyst for renewed investment by American VCs. The big unknown is whether Apple enters the smartphone tethered smartglasses market in late 2020 (as Digi-Capital has forecast for the last few years). This could be the tipping point for the market as a whole (not just investment). However, Apple timing is hard to predict (because Apple), with any potential launch date known only to Tim Cook and his immediate circle.

Steve Jobs said, “You can’t connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future. You have to trust in something – your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life.”

Chinese investors embraced a Jobsian approach over the last 12 months, with Western VCs increasingly dot-connecting (or not). It will be interesting to see how this plays out for computer vision/AR investment over the next 12 months, so watch this space.

from Apple – TechCrunch https://ift.tt/2DXyEry

Most iOS devices now run iOS 12 according to Mixpanel’s data

Analytics company Mixpanel is currently tracking the install base of iOS 12. And the latest version of iOS is quite popular as it’s already installed on roughly 47.6 percent of all iOS devices. 45.6 percent of devices still run iOS 11, and 6.9 percent of iOS users run an older version.

Adoption rate is an important metric for app developers. With major iOS releases, Apple also releases new frameworks. But developers still need to support old versions of iOS for a little bit before moving entirely to newer frameworks and drop support for old iOS versions.

But it’s interesting to see that you can already drop support for iOS 10 without losing too many customers. Chances are that users who don’t update their version of iOS don’t really care about having the latest version of your app anyway.

With iOS 11, it took much longer to reach that level. Last year, Apple announced on November 6th that iOS 11 was more popular than iOS 10. Sure, Mixpanel and Apple don’t have the exact same numbers, but you can already see that the trend is different this year.

iOS 12 focuses on performance. Apple has optimized this major release for older devices, such as the iPhone 6. All devices that run iOS 11 can update to iOS 12 as well. Basically, if you want a faster phone, you should update to iOS 12.

This is a bit counterintuitive as previous iOS releases had rendered older devices much slower. But it sounds like iOS users got the message based on the adoption rate.

from Apple – TechCrunch https://ift.tt/2y1f0FO