In this blog you can visit new technology latest news about advance technology viral news latest andriod phones and much more visit this blog for more updates daily thanks

Monday, 19 November 2018

Interest rates and fears of a mounting trade war send tech stocks lower

Shares of technology companies were battered in today’s trading as fears of an increasing trade war between the U.S. and China and rising interest rates convinced worried investors to sell.

The Nasdaq Composite Index, which is where many of the country’s largest technology companies trade their shares, was down 219.4 points, or 3%, to 7,028.48. Meanwhile, the Dow Jones Industrial Average fell 395.8 points, or 1.6%, to 25,017.44.

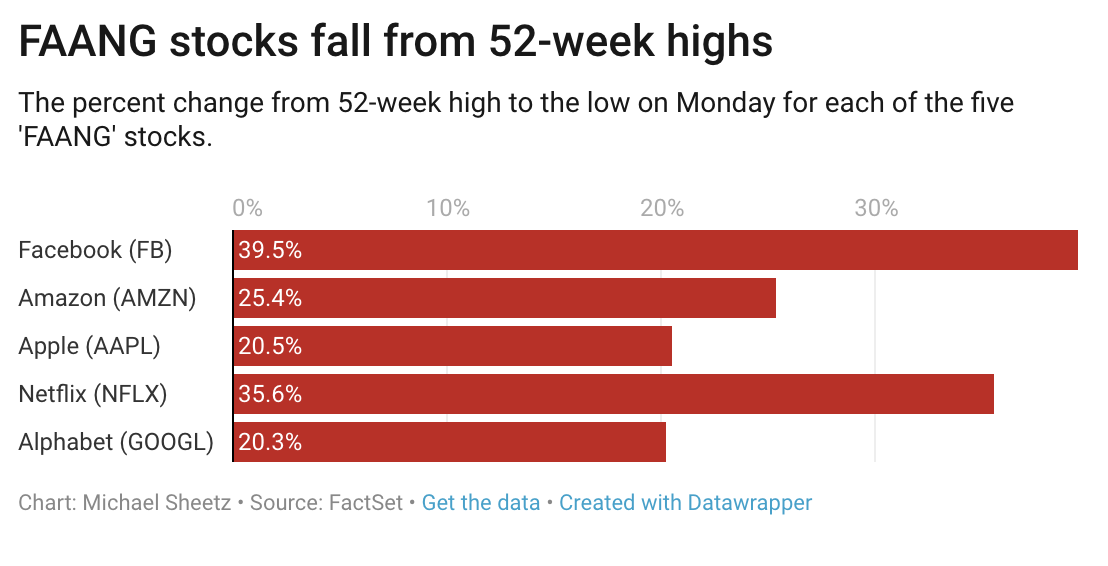

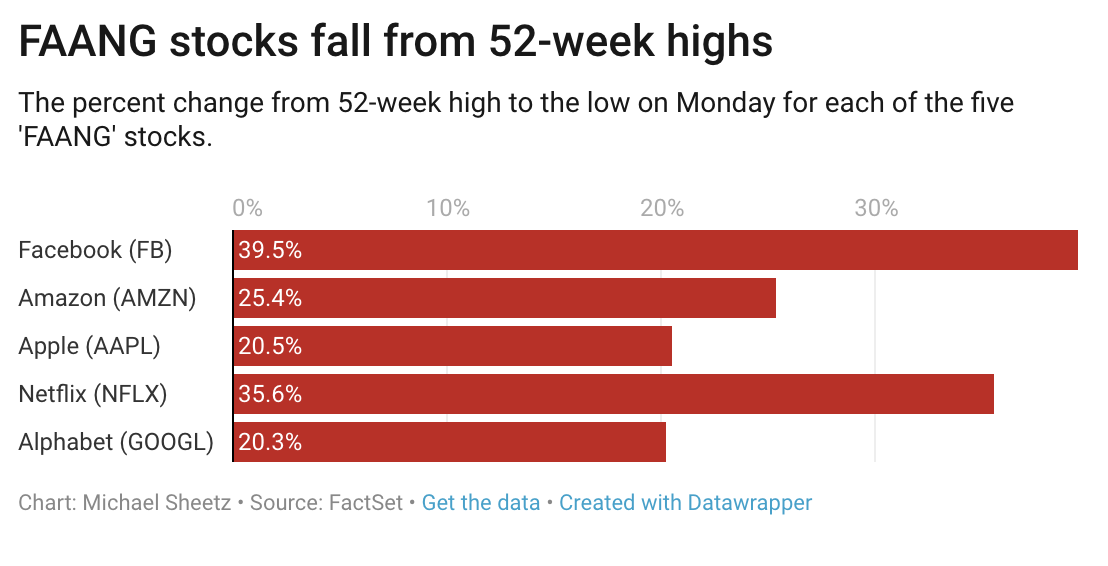

Facebook, Alphabet (the parent company of Google), Apple, Netflix and Amazon all fell into bear trading territory, which means that the value of these stocks have slid more than 20%. CNBC has a handy chart illustrating just how bad things have been for the largest tech companies in the U.S.

Some of the woes from tech stocks aren’t necessarily trade war related. Facebook shares have been hammered on the back of a blockbuster New York Times report detailing the missteps and misdirection involved in the company’s response to Russian interference in the U.S. elections. Investors are likely concerned that the company’s margins will shrink as it spends more on content moderation.

And Apple saw its shares decline on reports that sales of its new iPhones may not be as rosy as the company predicted — although the holiday season should boost those numbers. According to a Wall Street Journal report, Apple has cut the targets for all of its new phones amid uncertainties around sales.

The Journal reported that in recent weeks, Apple had cut its production orders for all of the iPhone models it unveiled in September, which has carried through the supply chain. Specifically, targets for the new iPhone XR were cut by one-third from the 70 million units the company had asked suppliers to produce, according to WSJ sources.

Those sales numbers had a ripple effect throughout Apple’s supply chain, hitting the stock prices for a number of suppliers and competitors.

But the U.S. government’s escalating trade war with China is definitely a concern for most of the technology industry as tariffs are likely to affect supply chains and drive prices higher.

According to a research note from Chris Zaccarelli, the chief investment officer at Independent Advisor Alliance, quoted in MarketWatch, interest rates and slowing global growth are adding to trade war pressures to drive tech stock prices down.

“Tech continues to be caught in the crosshairs of the triple threat of rising interest rates, global growth fears and trade tensions with China,” Zaccarelli wrote. “Trade war concerns with China weigh on the global supply chain for large technology companies while global growth fears worry many that future earnings will be lower,” he said.

from iPhone – TechCrunch https://ift.tt/2A528Pe

Interest rates and fears of a mounting trade war send tech stocks lower

Shares of technology companies were battered in today’s trading as fears of an increasing trade war between the U.S. and China and rising interest rates convinced worried investors to sell.

The Nasdaq Composite Index, which is where many of the country’s largest technology companies trade their shares, was down 219.4 points, or 3%, to 7,028.48. Meanwhile, the Dow Jones Industrial Average fell 395.8 points, or 1.6%, to 25,017.44.

Facebook, Alphabet (the parent company of Google), Apple, Netflix and Amazon all fell into bear trading territory, which means that the value of these stocks have slid more than 20%. CNBC has a handy chart illustrating just how bad things have been for the largest tech companies in the U.S.

Some of the woes from tech stocks aren’t necessarily trade war related. Facebook shares have been hammered on the back of a blockbuster New York Times report detailing the missteps and misdirection involved in the company’s response to Russian interference in the U.S. elections. Investors are likely concerned that the company’s margins will shrink as it spends more on content moderation.

And Apple saw its shares decline on reports that sales of its new iPhones may not be as rosy as the company predicted — although the holiday season should boost those numbers. According to a Wall Street Journal report, Apple has cut the targets for all of its new phones amid uncertainties around sales.

The Journal reported that in recent weeks, Apple had cut its production orders for all of the iPhone models it unveiled in September, which has carried through the supply chain. Specifically, targets for the new iPhone XR were cut by one-third from the 70 million units the company had asked suppliers to produce, according to WSJ sources.

Those sales numbers had a ripple effect throughout Apple’s supply chain, hitting the stock prices for a number of suppliers and competitors.

But the U.S. government’s escalating trade war with China is definitely a concern for most of the technology industry as tariffs are likely to affect supply chains and drive prices higher.

According to a research note from Chris Zaccarelli, the chief investment officer at Independent Advisor Alliance, quoted in MarketWatch, interest rates and slowing global growth are adding to trade war pressures to drive tech stock prices down.

“Tech continues to be caught in the crosshairs of the triple threat of rising interest rates, global growth fears and trade tensions with China,” Zaccarelli wrote. “Trade war concerns with China weigh on the global supply chain for large technology companies while global growth fears worry many that future earnings will be lower,” he said.

from Apple – TechCrunch https://ift.tt/2A528Pe

Friday, 16 November 2018

Walmart passes Apple to become No. 3 online retailer in U.S.

Walmart has overtaken Apple to become the No. 3 online retailer in the U.S., according to a report this week from eMarketer. While Amazon still leads by a wide margin, accounting for 48 percent of e-commerce sales in 2018, Walmart – including also Sam’s Club and Jet.com – is poised to capture 4 percent of all online retail spending in the U.S. by year-end, totaling $20.91 billion.

The news of the shift in e-commerce rankings comes alongside Walmart’s strong earnings which saw the retailer reporting a 43 percent increase in online sales and upping its year-end forecast for both earnings and sales.

The company had beat Wall St.’s expectations in its fiscal third quarter, with $1.08 earnings per share instead of the expected $1.01. However, it fell short on revenue with $124.89 billion versus the $125.55 billion expected, due to currency complications, it said.

eMarketer had estimated in July that Walmart would capture a 3.7 percent e-commerce share in the U.S. this year, but increased that to 4 percent based on its quickly growing online sales.

This year, Walmart’s online sales will grow by 39.4 percent – just slightly behind the growth rate for online furniture and home goods retailer Wayfair, which is expected to see sales grow by 40.1 percent, the firm also noted.

Apple, meanwhile, will grow just over 18 percent in 2018 – a slowdown related to slowing domestic sales for smartphones and other devices. Its portion of the e-commerce market is relatively unchanged from 2017 to 2018, going from 3.8 percent to 3.9 percent.

Walmart, by comparison, is increasing its share from 3.3 percent to 4.0 percent.

But both are behind eBay, now at 7.2 percent. And they’re both vastly outranked by Amazon, which will account for a whopping 48 percent of the U.S. e-commerce market in 2018, up from 43.1 percent last year.

Amazon will take in more than $252.10 billion domestically this year, eMarketer said.

“Walmart’s e-commerce business has been firing on all cylinders lately,” said eMarketer principal analyst Andrew Lipsman, said in a statement. “The retail giant continues to make smart acquisitions to extend its e-commerce portfolio and attract younger and more affluent shoppers. But more than anything, Walmart has caught its stride with a fast-growing online grocery business, which is helped in large part by the massive consumer adoption of click-and-collect.”

from Apple – TechCrunch https://ift.tt/2zYyN8N

Thursday, 15 November 2018

Apple partners with A24, the studio behind ‘Moonlight’ and ‘Hereditary’

Apple has signed a multi-year agreement with A24, which will see the film studio producing multiple movies for Apple.

Not much else is known about the deal yet — not the number of films, their genres or the talent involved. Still, the deal suggests that Apple is going to be investing seriously in original films, along with TV shows.

Over the past year or so, Apple’s been releasing a steady drumbeat of content announcements, for shows like an adaptation of Isaac Asimov’s “Foundation” novels, a drama set in the world of morning TV starring Jennifer Aniston and Reese Witherspoon and a series from “La La Land” director Damien Chazelle. What’s less clear is how Apple plans to distribute theses shows and movies, though there have been reports that it will give the content away for free to people who own iOS and tvOS devices.

A24, meanwhile, is a relatively new studio launched in 2012. It’s quickly established itself as a home for critically acclaimed films like “Moonlight” (winner of the Oscar for Best Picture) and “Lady Bird.” It’s also released some of the best science fiction and horror movies of the past few years, including “Ex Machina,” “The Lobster” and “Hereditary” (which gave me nightmares for a solid week).

The studio’s films have had a significant presence on streaming, thanks to an early, exclusive deal with Amazon Prime, but A24 has also had success in theaters — particularly noteworthy at a time when ambitious, original films seem increasingly likely to premiere on services like Netflix. In fact, Variety notes that this year has been A24’s most financially successful yet, thanks to in large part to “Hereditary.”

from Apple – TechCrunch https://ift.tt/2DlvCeG

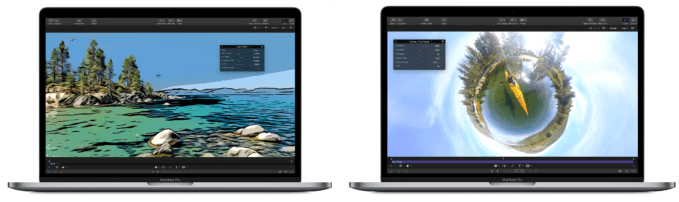

Apple’s Final Cut Pro X just got a big update — here’s what’s new

Apple’s pro-grade video editing tool Final Cut Pro X is getting a big update today.

While much of FCPX is getting polished up in this release, the biggest change is what it allows for moving forward: workflow extensions. These extensions allow third-party apps and services to hook right into FCPX and build on top of the native interface and functionality.

Apple partnered with three companies to build out extensions for launch day:

- Frame.io: Frame.io lets video producers share in-progress edits, allowing collaborators to view the project as it comes together and drop comments, frame-by-frame annotations and ideas directly into the relevant, time-synced section of your timeline. Frame.io has been building out this functionality within their own app for quite a while now — this new workflow extension just brings all of it right into FCPX to keep you from having to constantly switch back and forth.

- Shutterstock: Need some b-roll you didn’t think to shoot? The Shutterstock extension lets you drag watermarked photos/videos/music into your project for temporary use, then handles swapping in the licensed/unwatermarked stuff later.

- CatDV: If your team uses CatDV for handling/tagging its assets, the new extension lets you connect to your content catalog, search for tagged content and pull it right into a project.

While FCPX has had plug-ins for a while, these new workflow extensions are able to more tightly integrate into the app’s built-in interface. Third-party extensions will come straight from the Mac App Store. Apple says that anyone will be able to build an FCPX workflow extension through a newly built SDK, though it’s asking interested parties to reach out to them directly for now.

Meanwhile, some of the other changes coming to FCPX:

- A Comparison Viewer that lets you pin clips side-by-side (or drag in references from the web) to help with color correction and grading.

- A batch-sharing tool to help export multiple clips (or export into multiple formats) at once.

- A newly built video noise reduction effect for helping to cut down on grain while maintaining sharpness.

- A fancy “Tiny Planet” feature that can convert 360º video into a trippy spherical view

Apple is also pushing updates for Motion and Compressor, two apps it sells separately from FCPX on the App Store. Motion, Apple’s tool for building titles and transitions, is getting deeper color management tools to help get all the grading just right, along with a new comic book-style filter and a tiny planet feature similar to the one now built into Final Cut. Compressor, Apple’s dedicated tool for encoding your videos and prepping them for distribution, is being shifted over to a new 64-bit engine (though it’ll still work with 32-bit file formats). It’s also picking up the ability to burn subtitles directly into a video, and will at long last offer support for handling SRT subtitle files — particularly useful for anyone trying to upload straight from FCPX to Facebook, which will only accept SRTs.

All of the updates are free to existing users. For new users, Final Cut Pro X costs $300, while Motion and Compressor go for $50 each.

from Apple – TechCrunch https://ift.tt/2B8RgBn

Wednesday, 14 November 2018

MacBook Pro with updated GPU is now available

Apple recently unveiled a bunch of new products during a press event in New York. But the company also quietly shared a press release with new configurations for the 15-inch MacBook Pro. Customers can now get a MacBook Pro with an AMD Radeon Pro Vega 16 or Vega 20 graphics processing unit.

Before this update, users could only get Radeon Pro 555X or 560X GPUs. Those options are still available, but you can now pay a bit more money to get much better GPUs.

As the name suggests, Vega is a new generation of graphics processors. The iMac Pro comes with desktop-class Vega processors — the Vega 56 and Vega 64. The Vega 16 or Vega 20 are less powerful than the iMac Pro GPUs. But they also fit in a laptop and consume much less power.

In particular, Radeon Pro GPUs use GDDR5 memory just like the PlayStation 4 and Xbox One X. But Vega GPUs now take advantage of HBM2 memory, which provides more bandwidth and consumes less power.

It leads to a direct bump in performance. Apple says you can expect as much as 60 percent faster graphics performance. But we’ll have to wait for the benchmarks to know that for sure.

Vega GPUs are only available on the most expensive 15-inch MacBook Pro configuration that starts at $2,799 with a Radeon Pro 560X. Upgrading to the Vega 16 costs another $250, while the Vega 20 is $350 more expensive than the base model.

from Apple – TechCrunch https://ift.tt/2DDnXcD