In its clearest move yet to woo the healthcare industry, Apple has collaborated with the health insurance provider Aetna to launch a new app, called Attain, that uses Apple Watch data to provide a window into users’ health.

The launch stems from a 2016 collaboration between the insurer and Apple that saw 90 percent of participants in a study reported a health benefit from using their Apple Watch.

Both Apple and Google (through its parent company, Alphabet) have been making headway into personalized health using wearables. Earlier this month, Alphabet’s Verily business unit had its wearable device approved by the FDA for tracking heart health. Apple had received its approval from the FDA in September 2018 when it launched a new version of the Apple Watch.

“We believe that people should be able to play a more active role in managing their well-being. Every day, we receive emails and letters from people all over the world who have found great benefit by incorporating Apple Watch into their lives and daily routines,” said Jeff Williams, Apple’s COO. “As we learn over time, the goal is to make more customized recommendations that will help members accomplish their goals and live healthier lives.”

Healthcare has been on Apple’s radar since at least 2016, when Tim Cook targeted it as an area the company was looking to pursue in an interview with Fast Company:

“We’ve gotten into the health arena and we started looking at wellness, that took us to pulling a string to thinking about research, pulling that string a little further took us to some patient-care stuff, and that pulled a string that’s taking us into some other stuff,” [Cook said at the time]. “When you look at most of the solutions, whether it’s devices, or things coming up out of Big Pharma, first and foremost, they are done to get the reimbursement [from an insurance provider]. Not thinking about what helps the patient. So if you don’t care about reimbursement, which we have the privilege of doing, that may even make the smartphone market look small.”

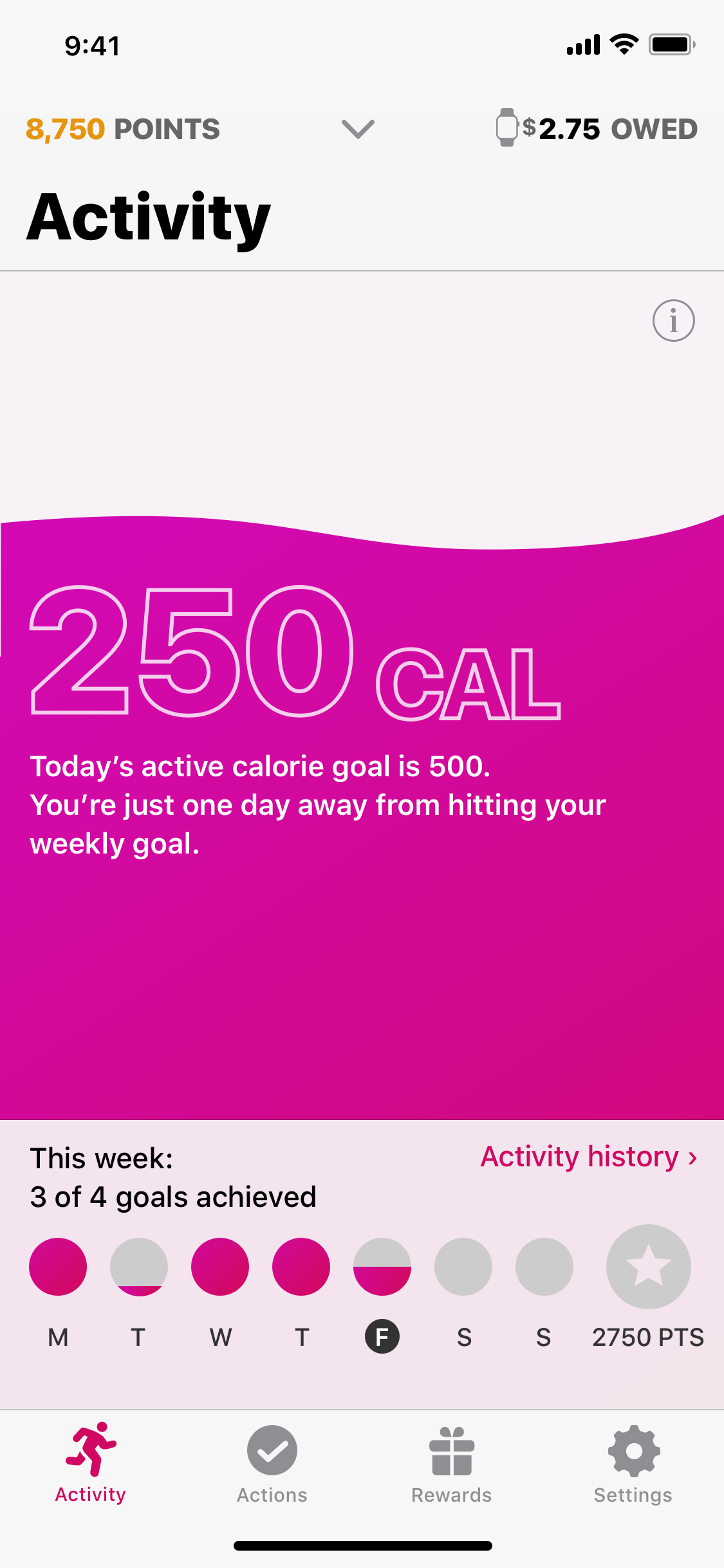

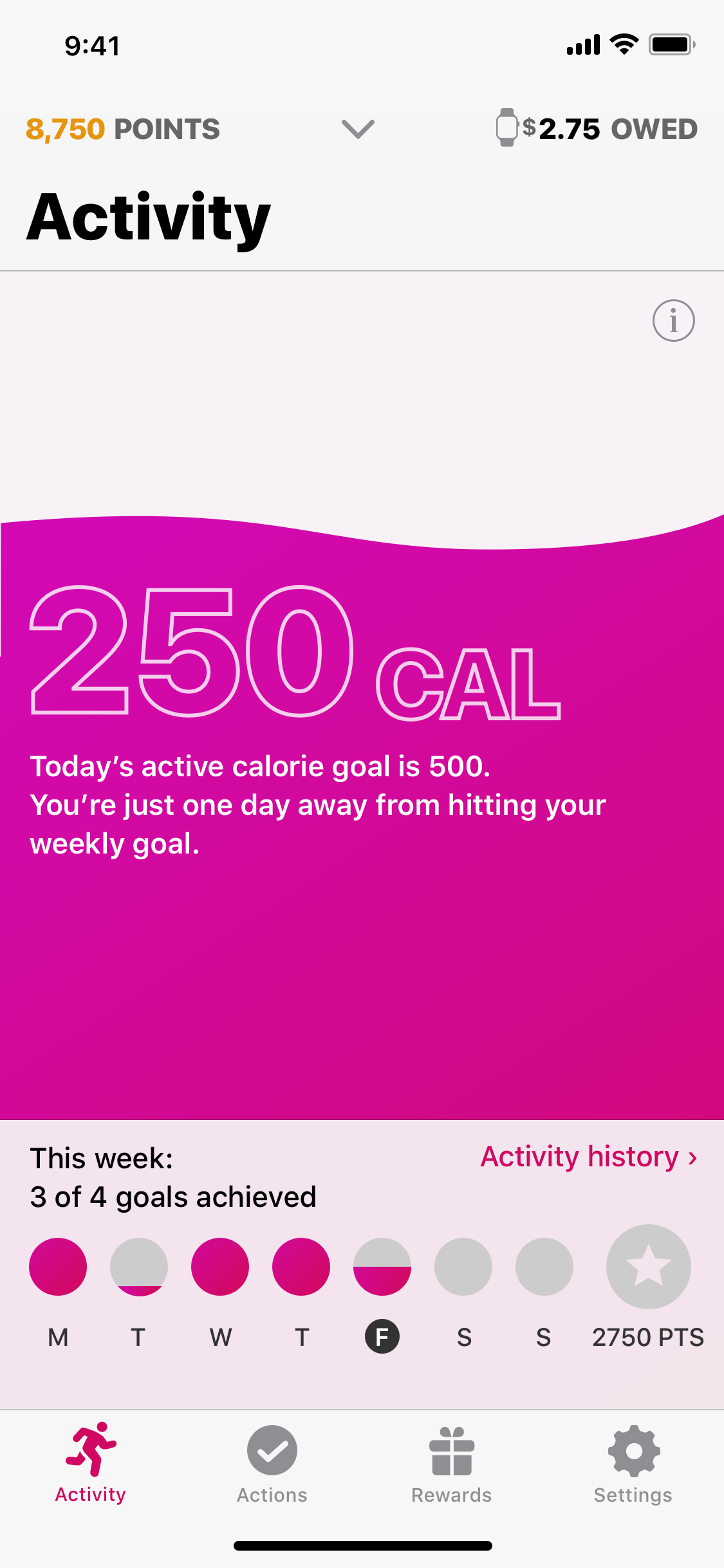

The new Attain app consists of four pillars divided into achieving activity goals; sustaining everyday health, personalized health notifications; and rewards for achievements.

The app determines personalized activity goals based on age, sex and weight, and includes a more varied array of potential activities than just steps taken — using the Apple Watch to measure swimming and yoga as potential activities.

Aetna’s app will also offer challenges where participants earn points for taking actions like getting more sleep, engaging in meditation activities and monitoring and improving their diet.

Attain will also recommend health actions based on the healthcare reports culled from the health records that Aetna’s patient population shares through the app. Created alongside physicians, the app uses doctor-recommended clinical guidelines and will incorporate prompts for healthy actions, like getting flu shots and vaccinations, refilling medication prescriptions when they’re scheduled to run out; suggesting visits to primary care physicians if checkups have lagged and prompting about lower-cost options for lab tests.

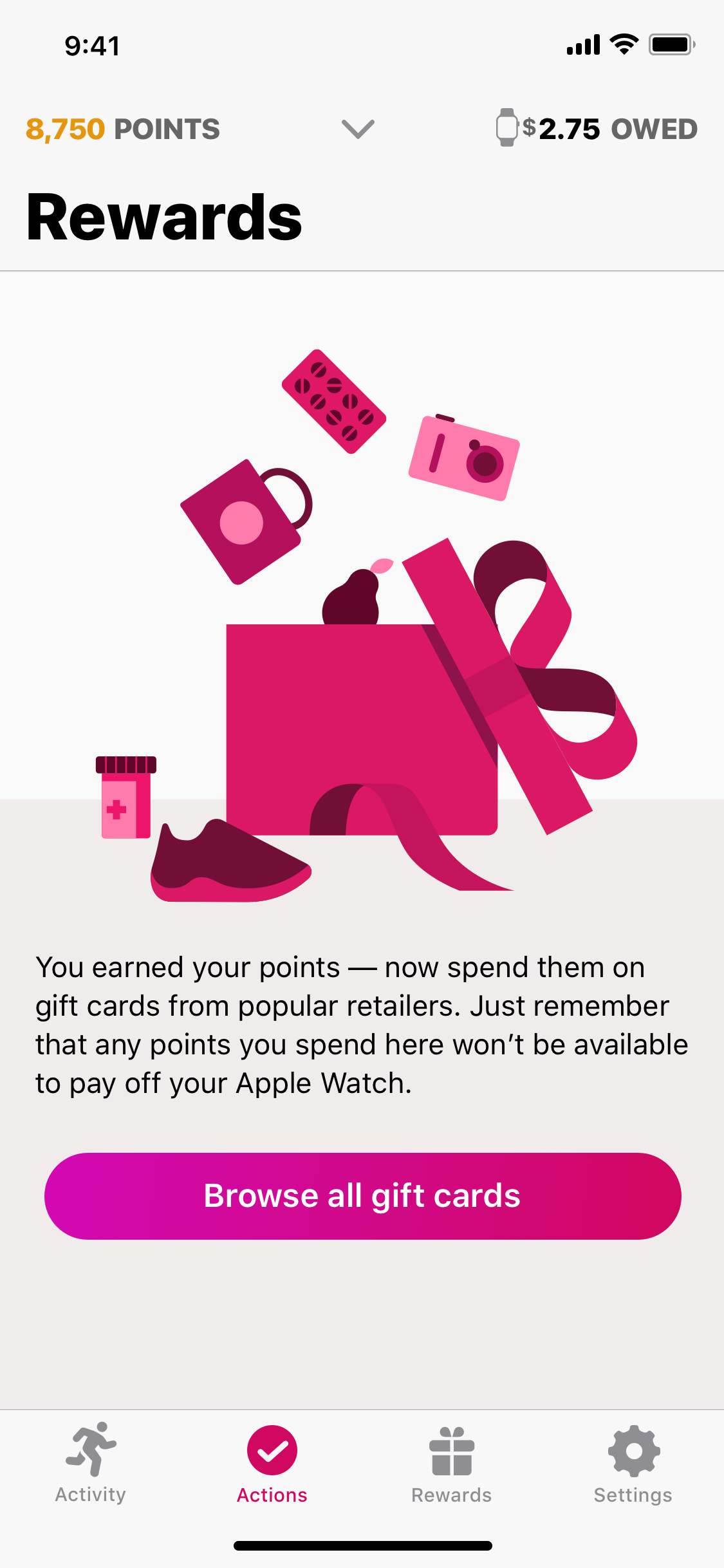

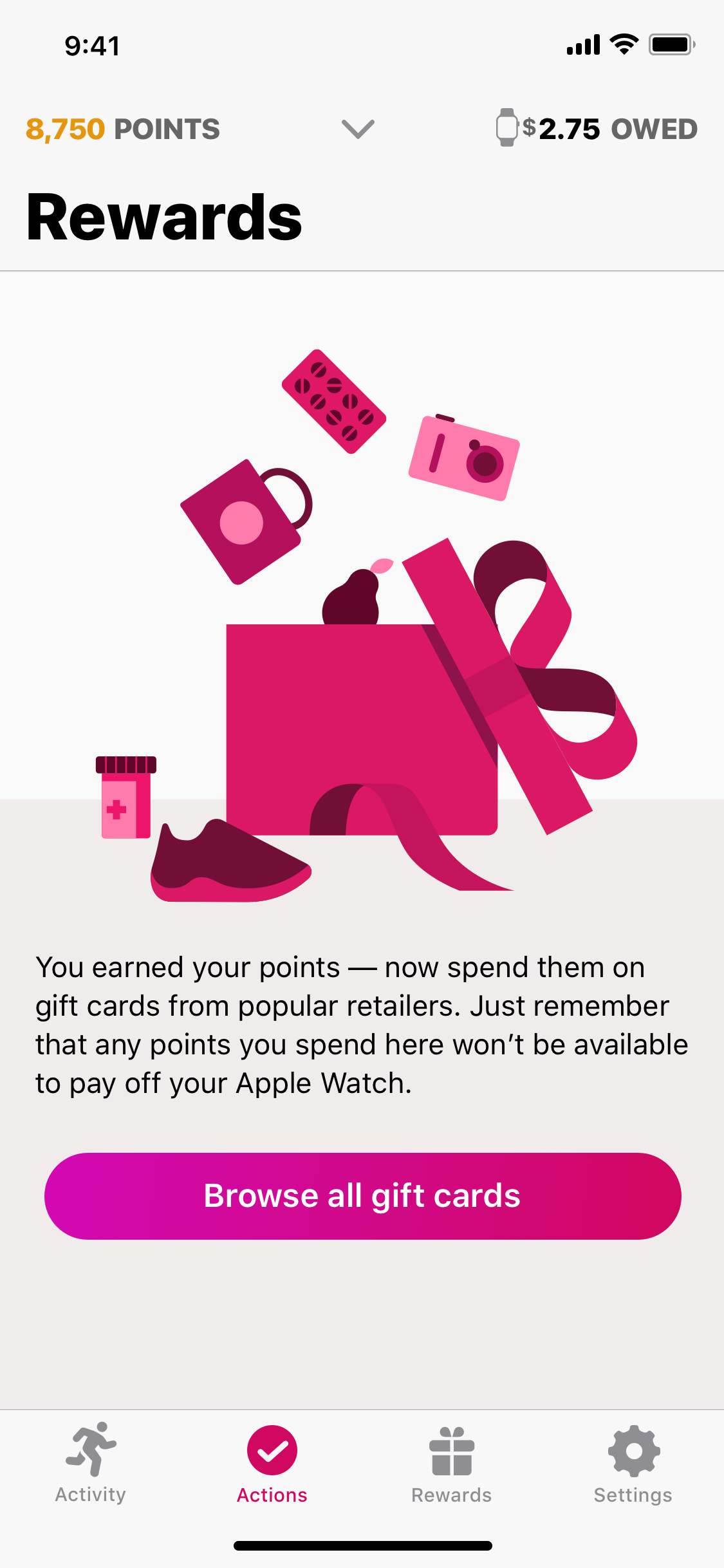

Finally, users can earn rewards — like points off the cost of their Apple Watch or gift cards to national stores. The app is available to Aetna members who have an iPhone 5s or later and an Apple Watch Series 1 or later.

“From fitness enthusiasts, to casual gym-goers, to parents who get all their exercise by keeping up with their kids – we designed Attain for everyone,” said Alan Lotvin, M.D., executive vice president of Transformation for CVS Health, in a statement. “We understand that you don’t need to be a personal trainer or work out several hours a day to be healthier. We’re designing Attain to be personalized and clinically relevant to where each individual is in their health journey. This is an ambitious challenge, and we will adapt and improve over time to create the best experience for our members.”

After users have signed up with the Attain app they can share data and health history with Apple, giving both companies access to data that can be used later for potential clinical trials or to make predictions abut population health… while the companies are pitching it as a way to get more personalized suggestions from the app.

According to a statement from the company, all the health data is encrypted on the device, in transit and on Apple and Aetna’s servers where it is stored in a HIPAA-compliant way.

The companies also say that the data won’t be used for underwriting, premium or coverage decisions.

In the future you could see Apple and Aetna collaborating to make Apple Watches an employee benefit — like computers — to track employee health and lower healthcare costs. It’d be a win-win for both.

But as Apple pushes deeper into collecting health records and data, the company is setting a high bar for its security protocols at a time when the company is still cleaning up the mess from a bug that left FaceTime users exposed.

from Apple – TechCrunch https://tcrn.ch/2GaQJlh