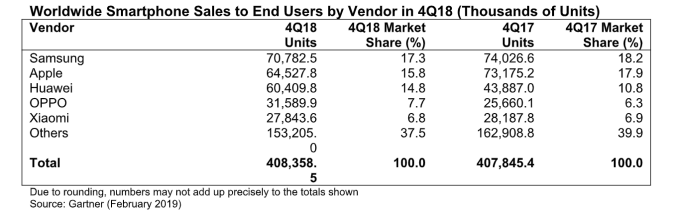

Gartner’s smartphone marketshare data for the just gone holiday quarter highlights the challenge for device makers going into the world’s biggest mobile trade show which kicks off in Barcelona next week: The analyst’s data shows global smartphone sales stalled in Q4 2018, with growth of just 0.1 per cent over 2017’s holiday quarter, and 408.4 million units shipped.

tl;dr: high end handset buyers decided not to bother upgrading their shiny slabs of touch-sensitive glass.

Gartner says Apple recorded its worst quarterly decline (11.8 per cent) since Q1 2016, though the iPhone maker retained its second place position with 15.8 per cent marketshare behind market leader Samsung (17.3 per cent). Last month the company warned investors to expect reduced revenue for its fiscal Q1 — and went on to report iPhone sales down 15 per cent year over year.

The South Korean mobile maker also lost share year over year (declining around 5 per cent), with Gartner noting that high end devices such as the Galaxy S9, S9+ and Note9 struggled to drive growth, even as Chinese rivals ate into its mid-tier share.

Huawei was one of the Android rivals causing a headache for Samsung. It bucked the declining share trend of major vendors to close the gap on Apple from its third placed slot — selling more than 60 million smartphones in the holiday quarter and expanding its share from 10.8 per cent in Q4 2017 to 14.8 per cent.

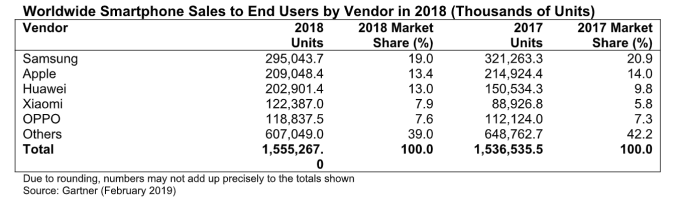

Gartner has dubbed 2018 “the year of Huawei”, saying it achieved the top growth of the top five global smartphone vendors and grew throughout the year.

This growth was not just in Huawei “strongholds” of China and Europe but also in Asia/Pacific, Latin America and the Middle East, via continued investment in those regions, the analyst noted. While its expanded mid-tier Honor series helped the company exploit growth opportunities in the second half of the year “especially in emerging markets”.

By contrast Apple’s double-digit decline made it the worst performer of the holiday quarter among the top five global smartphone vendors, with Gartner saying iPhone demand weakened in most regions, except North America and mature Asia/Pacific.

It said iPhone sales declined most in Greater China, where it found Apple’s market share dropped to 8.8 percent in Q4 (down from 14.6 percent in the corresponding quarter of 2017). For 2018 as a whole iPhone sales were down 2.7 percent, to just over 209 million units, it added.

“Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones. It also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple’s unit sales growth prospects,” said Gartner’s Anshul Gupta, senior research director, in a statement.

“Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018. Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones,” he added.

Further down the smartphone leaderboard, Chinese OEM, Oppo, grew its global smartphone market share in Q4 to bump Chinese upstart, Xiaomi, and bag fourth place — taking 7.7 per cent vs Xiaomi’s 6.8 per cent for the holiday quarter.

The latter had a generally flat Q4, with just a slight decline in units shipped, according to Gartner’s data — underlining Xiaomi’s motivations for teasing a dual folding smartphone.

Because, well, with eye-catching innovation stalled among the usual suspects (who’re nontheless raising high end handset prices), there’s at least an opportunity for buccaneering underdogs to smash through, grab attention and poach bored consumers.

Or that’s the theory. Consumer interest in ‘foldables’ very much remains to be tested.

In 2018 as a whole, the analyst says global sales of smartphones to end users grew by 1.2 percent year over year, with 1.6 billion units shipped.

The worst declines of the year were in North America, mature Asia/Pacific and Greater China (6.8 percent, 3.4 percent and 3.0 percent, respectively), it added.

“In mature markets, demand for smartphones largely relies on the appeal of flagship smartphones from the top three brands — Samsung, Apple and Huawei — and two of them recorded declines in 2018,” noted Gupta.

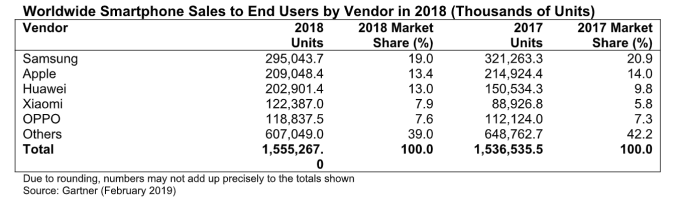

Overall, smartphone market leader Samsung took 19.0 percent marketshare in 2018, down from 20.9 per cent in 2017; second placed Apple took 13.4 per cent (down from 14.0 per cent in 2017); third placed Huawei took 13.0 per cent (up from 9.8 per cent the year before); while Xiaomi, in fourth, took a 7.9 per cent share (up from 5.8 per cent); and Oppo came in fifth with 7.6 per cent (up from 7.3 per cent).

from iPhone – TechCrunch https://ift.tt/2GARVzt