With last fall’s release of iOS 12, Apple introduced Siri Shortcuts — a new app that allows iPhone users to create their own voice commands to take actions on their phone and in apps. Today, Apple is celebrating Global Accessibility Awareness Day (GAAD) by rolling out a practical, accessibility focused collection of new Siri Shortcuts, alongside accessibility focused App Store features and collections.

Google is doing something similar for Android users on Google Play.

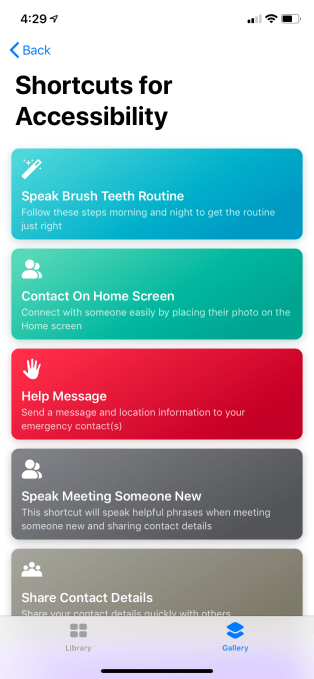

For starters, Apple’s new Siri shortcuts are available today in a featured collection at the top of the Shortcuts app. The collection includes a variety of shortcuts aimed at helping users more quickly perform everyday tasks.

For example, there’s a new “Help Message” shortcut that will send your location to an emergency contact, a “Meeting Someone New” shortcut designed to speed up non-verbal introductions and communication, a mood journal for recording thoughts and feelings, a pain report that helps to communicate to others the location and intensity of your pain and several others.

Some are designed to make communication more efficient — like one that puts a favorite contact on the user’s home screen, so they can quickly call, text or FaceTime the contact with just a tap.

Others are designed to be used with QR codes. For example, “QR Your Shortcuts” lets you create a QR code for any shortcut you regularly use, then print it out and place it where it’s needed for quick access — like the “Speak Brush Teeth Routine” shortcut that speaks step-by-step instructions for teeth brushing, which would be placed in the bathroom.

In addition to the launch of the new shortcuts, Apple added a collection of accessibility focused apps to the App Store which highlights a ton of accessibility focused apps, including Microsoft’s new talking camera for the blind called Seeing AI, plus other utilities like text-to-speech readers, audio games, sign language apps, AAC (Augmentative and Alternative Communication) solutions, eye-controlled browsers, smart home apps, fine motor skill trainers and much more.

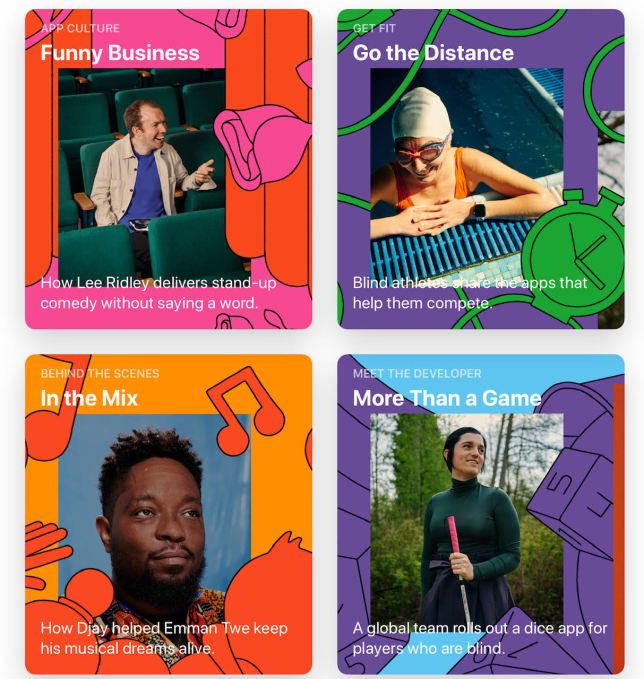

The App Store is also today featuring several interviews with developers, athletes, musicians and a comedian who talk about how they use accessible technology.

Apple is not the only company rolling out special GAAD-themed collections today. Google also unveiled its own editorial collection of accessible apps and games on Google Play. In addition to several utilities, the collection features Live Transcribe, Google’s brand-new accessibility service for the deaf and hard of hearing that debuted earlier this month at its annual Google I/O developer conference.

Though the app’s status is “Unreleased,” users can install the early version, which listens to conversations around you, then instantly transcribes them.

Other selections include home screen replacement Nova Launcher, blind assistant app Be My Eyes, head control for the device Open Sesame, communication aid Card Talk and more.

from Apple – TechCrunch https://tcrn.ch/2Ywxp83