Facebook spying on teens, Twitter accounts hijacked by terrorists, and sexual abuse imagery found on Bing and Giphy were amongst the ugly truths revealed by TechCrunch’s investigating reporting in 2019. The tech industry needs more watchdogs than ever as its size enlargens the impact of safety failures and the abuse of power. Whether through malice, naivety, or greed, there was plenty of wrongdoing to sniff out.

Led by our security expert Zack Whittaker, TechCrunch undertook more long-form investigations this year to tackle these growing issues. Our coverage of fundraises, product launches, and glamorous exits only tell half the story. As perhaps the biggest and longest running news outlet dedicated to startups (and the giants they become), we’re responsible for keeping these companies honest and pushing for a more ethical and transparent approach to technology.

If you have a tip potentially worthy of an investigation, contact TechCrunch at tips@techcrunch.com or by using our anonymous tip line’s form.

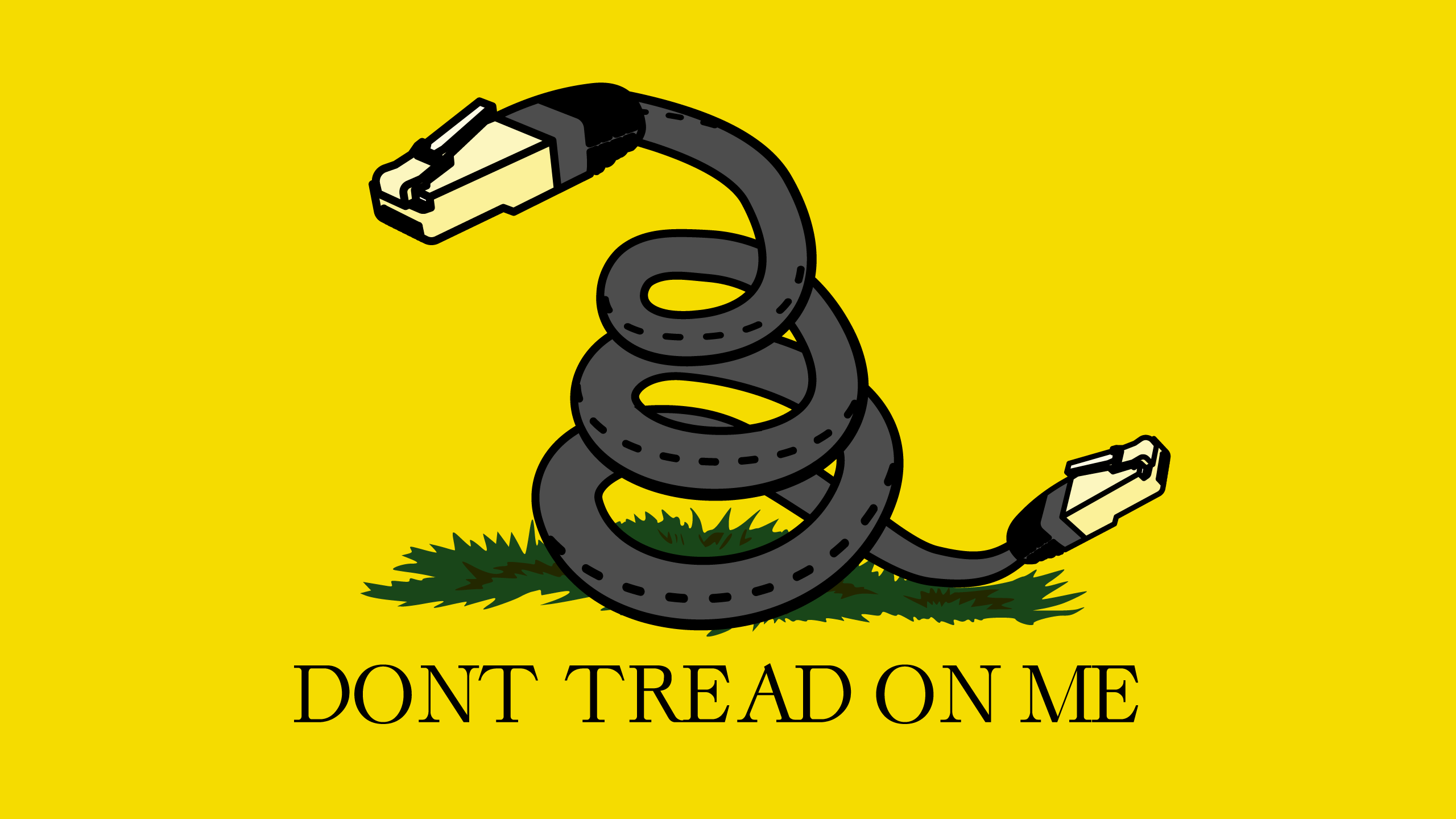

Image: Bryce Durbin/TechCrunch

Here are our top 10 investigations from 2019, and their impact:

Facebook pays teens to spy on their data

Josh Constine’s landmark investigation discovered that Facebook was paying teens and adults $20 in gift cards per month to install a VPN that sent Facebook all their sensitive mobile data for market research purposes. The laundry list of problems with Facebook Research included not informing 187,000 users the data would go to Facebook until they signed up for “Project Atlas”, not receiving proper parental consent for over 4300 minors, and threatening legal action if a user spoke publicly about the program. The program also abused Apple’s enterprise certificate program designed only for distribution of employee-only apps within companies to avoid the App Store review process.

The fallout was enormous. Lawmakers wrote angry letters to Facebook. TechCrunch soon discovered a similar market research program from Google called Screenwise Meter that the company promptly shut down. Apple punished both Google and Facebook by shutting down all their employee-only apps for a day, causing office disruptions since Facebookers couldn’t access their shuttle schedule or lunch menu. Facebook tried to claim the program was above board, but finally succumbed to the backlash and shut down Facebook Research and all paid data collection programs for users under 18. Most importantly, the investigation led Facebook to shut down its Onavo app, which offered a VPN but in reality sucked in tons of mobile usage data to figure out which competitors to copy. Onavo helped Facebook realize it should acquire messaging rival WhatsApp for $19 billion, and it’s now at the center of anti-trust investigations into the company. TechCrunch’s reporting weakened Facebook’s exploitative market surveillance, pitted tech’s giants against each other, and raised the bar for transparency and ethics in data collection.

Protecting The WannaCry Kill Switch

Zack Whittaker’s profile of the heroes who helped save the internet from the fast-spreading WannaCry ransomware reveals the precarious nature of cybersecurity. The gripping tale documenting Marcus Hutchins’ benevolent work establishing the WannaCry kill switch may have contributed to a judge’s decision to sentence him to just one year of supervised release instead of 10 years in prison for an unrelated charge of creating malware as a teenager.

The dangers of Elon Musk’s tunnel

TechCrunch contributor Mark Harris’ investigation discovered inadequate emergency exits and more problems with Elon Musk’s plan for his Boring Company to build a Washington D.C.-to-Baltimore tunnel. Consulting fire safety and tunnel engineering experts, Harris build a strong case for why state and local governments should be suspicious of technology disrupters cutting corners in public infrastructure.

Bing image search is full of child abuse

Josh Constine’s investigation exposed how Bing’s image search results both showed child sexual abuse imagery, but also suggested search terms to innocent users that would surface this illegal material. A tip led Constine to commission a report by anti-abuse startup AntiToxin (now L1ght), forcing Microsoft to commit to UK regulators that it would make significant changes to stop this from happening. However, a follow-up investigation by the New York Times citing TechCrunch’s report revealed Bing had made little progress.

Expelled despite exculpatory data

Zack Whittaker’s investigation surfaced contradictory evidence in a case of alleged grade tampering by Tufts student Tiffany Filler who was questionably expelled. The article casts significant doubt on the accusations, and that could help the student get a fair shot at future academic or professional endeavors.

Burned by an educational laptop

Natasha Lomas’ chronicle of troubles at educational computer hardware startup pi-top, including a device malfunction that injured a U.S. student. An internal email revealed the student had suffered a “a very nasty finger burn” from a pi-top 3 laptop designed to be disassembled. Reliability issues swelled and layoffs ensued. The report highlights how startups operating in the physical world, especially around sensitive populations like students, must make safety a top priority.

Giphy fails to block child abuse imagery

Sarah Perez and Zack Whittaker teamed up with child protection startup L1ght to expose Giphy’s negligence in blocking sexual abuse imagery. The report revealed how criminals used the site to share illegal imagery, which was then accidentally indexed by search engines. TechCrunch’s investigation demonstrated that it’s not just public tech giants who need to be more vigilant about their content.

Airbnb’s weakness on anti-discrimination

Megan Rose Dickey explored a botched case of discrimination policy enforcement by Airbnb when a blind and deaf traveler’s reservation was cancelled because they have a guide dog. Airbnb tried to just “educate” the host who was accused of discrimination instead of levying any real punishment until Dickey’s reporting pushed it to suspend them for a month. The investigation reveals the lengths Airbnb goes to in order to protect its money-generating hosts, and how policy problems could mar its IPO.

Expired emails let terrorists tweet propaganda

Zack Whittaker discovered that Islamic State propaganda was being spread through hijacked Twitter accounts. His investigation revealed that if the email address associated with a Twitter account expired, attackers could re-register it to gain access and then receive password resets sent from Twitter. The article revealed the savvy but not necessarily sophisticated ways terrorist groups are exploiting big tech’s security shortcomings, and identified a dangerous loophole for all sites to close.

Porn & gambling apps slip past Apple

Josh Constine found dozens of pornography and real-money gambling apps had broken Apple’s rules but avoided App Store review by abusing its enterprise certificate program — many based in China. The report revealed the weak and easily defrauded requirements to receive an enterprise certificate. Seven months later, Apple revealed a spike in porn and gambling app takedown requests from China. The investigation could push Apple to tighten its enterprise certificate policies, and proved the company has plenty of its own problems to handle despite CEO Tim Cook’s frequent jabs at the policies of other tech giants.

Bonus: HQ Trivia employees fired for trying to remove CEO

This Game Of Thrones-worthy tale was too intriguing to leave out, even if the impact was more of a warning to all startup executives. Josh Constine’s look inside gaming startup HQ Trivia revealed a saga of employee revolt in response to its CEO’s ineptitude and inaction as the company nose-dived. Employees who organized a petition to the board to remove the CEO were fired, leading to further talent departures and stagnation. The investigation served to remind startup executives that they are responsible to their employees, who can exert power through collective action or their exodus.

If you have a tip for Josh Constine, you can reach him via encrypted Signal or text at (585)750-5674, joshc at TechCrunch dot com, or through Twitter DMs

from Apple – TechCrunch https://ift.tt/30KNeut