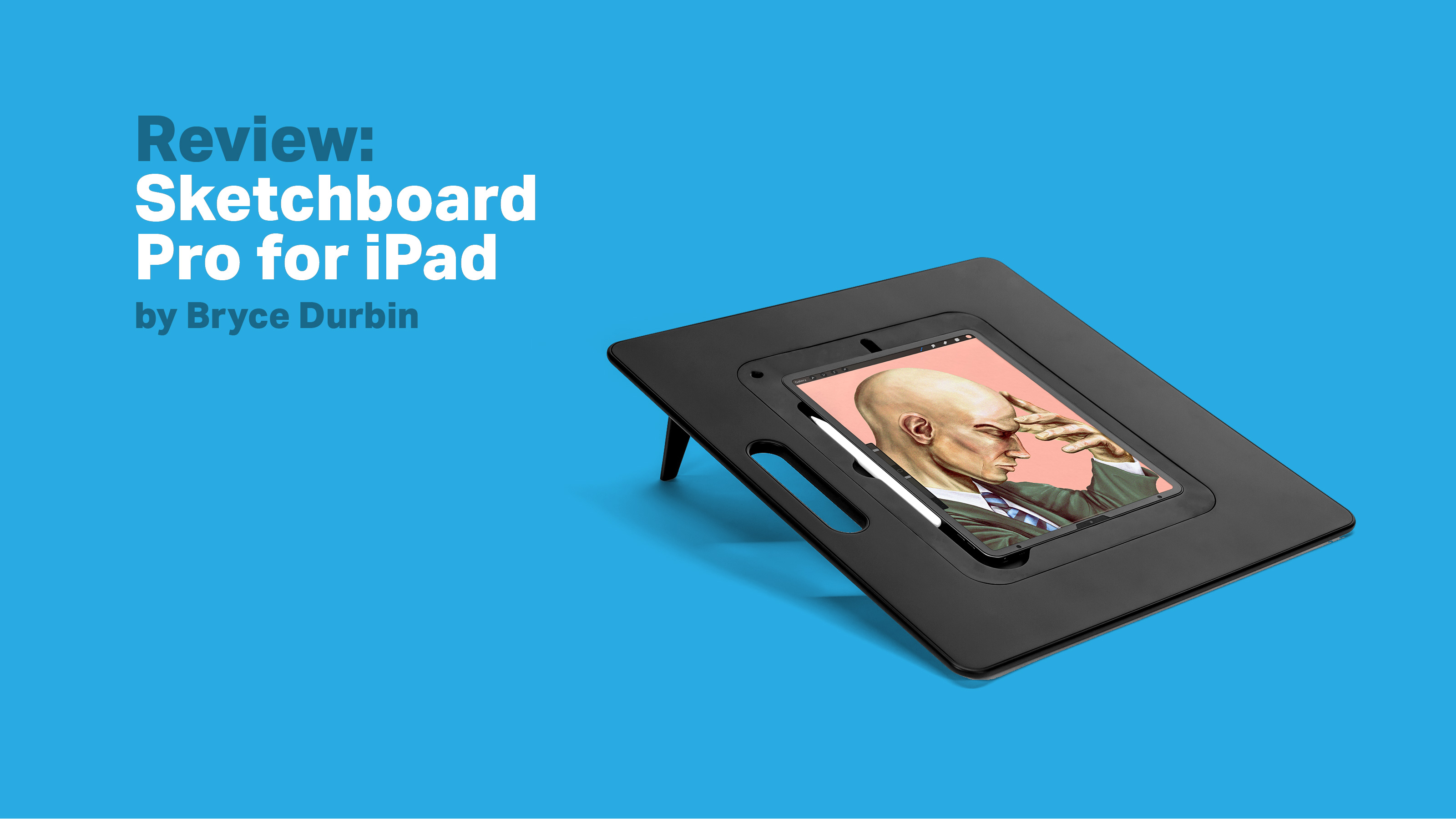

Image Credits: Sketchboard Pro

![[text] The Sketchboard Pro is an iPad stand designed for artists. It’s compatible with over 30 sizes of iPad. It retails for $119. There are spots for placing an Apple Pencil upright or connected to the iPad for charging as well as openings for the camera and power cable. The iPad fits snugly so the entire surface is flat. [image: Three views of the Sketchboard Pro from overhead, one empty, one with an iPad being inserted as well as a power cord and one with an iPad in place.]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-02.jpg)

![[text] There are four pop-out legs on the back so the board can stand (with two legs at a time) at an angle in any direction. The board measures 19.5 x 17 inches (49.5 x 43.2 cm). [image: two back views of the Sketchboard Pro, one with legs collapsed and one with legs out.]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-03.jpg)

![[text] The Sketchboard Pro sits at a 20 degree angle and weighs 4.5 lbs (about 2 kg). It can also stand upright like an easel, but I found this position to be less stable. [image: side views of the Sketchboard Pro to demonstrate a 20 degree angle]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-04.jpg)

![[text] I tested the Sketchboard Pro with a 12.9” iPad (2019). Combined, they weighed about 5.6 lbs (2.54 kg). I found the board easy to use at a desk or table, but more cumbersome in casual settings such as a couch. [image: illustrations of holding the Sketchboard Pro by the handle and sitting and drawing]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-05.jpg)

![[text] The Sketchboard Pro is a handy accessory for artists who work extensively on the iPad. I’d recommend it if you’re looking for a digital drawing setup to mimic a traditional drafting table and hoping to save your posture. [image: an illustration of the Sketchboard Pro]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-06.jpg)

from Apple – TechCrunch https://ift.tt/3lrA8e6

In this blog you can visit new technology latest news about advance technology viral news latest andriod phones and much more visit this blog for more updates daily thanks

We are now into the all-important holiday sales period, and new numbers from Gartner point to some recovery underway for the smartphone market as vendors roll out a raft of new 5G handsets.

Q3 smartphone figures from the analysts published today showed that smartphone unit sales were 366 million units, a decline of 5.7% globally compared to the same period last year. Yes, it’s a drop; but it is still a clear improvement on the first half of this year, when sales slumped by 20% in each quarter, due largely to the effects of COVID-19 on spending and consumer confidence overall.

That confidence is being further bolstered by some other signals. We are coming out of a relatively strong string of sales days over the Thanksgiving weekend, traditionally the “opening” of the holiday sales cycle. While sales on Thursday and Black Friday were at the lower end of predicted estimates, they still set records over previous years. With a lot of tech like smartphones often bought online, this could point to stronger numbers for smartphone sales as well.

On top of that, last week IDC — which also tracks and analyses smartphones sales — published a report predicting that sales would grow 2.4% in Q4 compared to 2019’s Q4. Its take is that while 5G smartphones will drive buying, prices still need to come down on these newer generation handsets to really see them hit with wider audiences. The average selling price for a 5G-enabled smartphone in 2020 is $611, said IDC, but it thinks that by 2024 that will come down to $453, likely driven by Android-powered handsets, which have collectively dominated smartphone sales for years.

Indeed, in terms of brands, Samsung, with its Android devices, continued to lead the pack in terms of overall units, with 80.8 million units, and a 22% market share. In fact, the Korean handset maker and China’s Xiaomi were the only two in the top five to see growth in their sales in the quarter, respectively at 2.2% and 34.9%. Xiaomi’s numbers were strong enough to see it overtake Apple for the quarter to become the number-three slot in terms of overall sales rankings. Huawei just about held on to number two. See the full chart further down in this story with more detail.

Also worth noting: Overall mobile sales — a figure that includes both smartphones and feature phones — were down 8.7% to 401 million units. That underscores not just how few feature phones are selling at the moment (smartphones can often even be cheaper to buy, depending on the brands involved or the carrier bundles), but also that those less sophisticated devices are seeing even more sales pressure than more advanced models.

It’s worth remembering that even before the global health pandemic, smartphone sales were facing slowing growth. The reasons: After a period of huge enthusiasm from consumers to pick up devices, many countries reached market penetration. And then, the latest features were too incremental to spur people to sell up and pay a premium on newer models.

In that context, the big hope from the industry has been 5G, which has been marketed by both carriers and handset makers as having more data efficiency and speed than older technologies. Yet when you look at the wider roadmap for 5G, rollout has remained patchy, and consumers by and large are still not fully convinced they need it.

Notably, in this past quarter, there is still some evidence that emerging/developing markets continue to have an impact on growth — in contrast to new features being drivers in penetrated markets.

“Early signs of recovery can be seen in a few markets, including parts of mature Asia/Pacific and Latin America. Near normal conditions in China improved smartphone production to fill in the supply gap in the third quarter which benefited sales to some extent,” said Anshul Gupta, senior research director at Gartner, in a statement. “For the first time this year, smartphone sales to end users in three of the top five markets i.e., India, Indonesia and Brazil increased, growing 9.3%, 8.5% and 3.3%, respectively.”

The more positive Q3 figures coincide with a period this summer that saw new COVID-19 cases slowing down in many places and the relaxation of many restrictions, so now all eyes are on this coming holiday period, at a time when COVID-19 cases have picked up with a vengeance, and with no rollout (yet) of large-scale vaccination or therapeutic programs. That is having an inevitable drag on the economy.

“Consumers are limiting their discretionary spend even as some lockdown conditions have started to improve,” said Gupta of the Q3 numbers. “Global smartphone sales experienced moderate growth from the second quarter of 2020 to the third quarter. This was due to pent-up demand from previous quarters.”

Digging into the numbers, Samsung has held on to its top spot, although its growth was significantly less strong in the quarter. Even with that slump, Samsung is still a long way ahead.

That is in part because number-two Huawei, with 51.8 million units sold, was down by more than 21% since last year. It has been having a hard time in the wake of a public relations crisis after sanctions in the U.S. and U.K., due to accusations that its equipment is used by China for spying. (Those U.K. sanctions, indeed, have been brought up in timing, just as of last night.)

That also led Huawei earlier this month to confirm the long-rumored plan to sell off its Honor smartphone division. That deal will involve selling the division, reportedly valued at around $15 billion, to a consortium of companies.

It will be interesting to see how Apple’s small decline of 0.6% to 40.6 million units to Xiaomi’s 44.4 million will shift in the next quarter on the back of the company launching a new raft of iPhone 12 devices.

“Apple sold 40.5 million units in the third quarter of 2020, a decline of 0.6% as compared to 2019,” said Annette Zimmermann, research vice president at Gartner, in a statement. “The slight decrease was mainly due to Apple’s delayed shipment start of its new 2020 iPhone generation, which in previous years would always start mid/end September. This year, the launch event and shipment start began 4 weeks later than usual.”

Oppo, which is still not available through carriers or retail partners in the U.S., rounded out the top five sellers with just under 30 million phones sold. The fact that it and Xiaomi do so well despite not really having a phone presence in the U.S. is an interesting testament to what kind of role the U.S. plays in the global smartphone market: huge in terms of perception, but perhaps less so when the chips are down.

“Others” — that category that can take in the long tail of players who make phones, continues to be a huge force, accounting for more sales than any one of the top five. That underscores the fragmentation in the Android-based smartphone industry, but all the same, its collective numbers were in decline, a sign that consumers are indeed slowly continuing to consolidate around a smaller group of trusted brands.

| Vendor | 3Q20

Units |

3Q20 Market Share (%) | 3Q19

Units |

3Q19 Market Share (%) | 3Q20-3Q19 Growth (%) |

| Samsung | 80,816.0 | 22.0 | 79,056.7 | 20.3 | 2.2 |

| Huawei | 51,830.9 | 14.1 | 65,822.0 | 16.9 | -21.3 |

| Xiaomi | 44,405.4 | 12.1 | 32,927.9 | 8.5 | 34.9 |

| Apple | 40,598.4 | 11.1 | 40,833.0 | 10.5 | -0.6 |

| OPPO | 29,890.4 | 8.2 | 30,581.4 | 7.9 | -2.3 |

| Others | 119,117.4 | 32.5 | 139,586.7 | 35.9 | -14.7 |

| Total | 366,658.6 | 100.0 | 388,807.7 | 100.0 | -5.7 |

Source: Gartner (November 2020)

We are now into the all-important holiday sales period, and new numbers from Gartner point to some recovery underway for the smartphone market as vendors roll out a raft of new 5G handsets.

Q3 smartphone figures from the analysts published today showed that smartphone unit sales were 366 million units, a decline of 5.7% globally compared to the same period last year. Yes, it’s a drop; but it is still a clear improvement on the first half of this year, when sales slumped by 20% in each quarter, due largely to the effects of COVID-19 on spending and consumer confidence overall.

That confidence is being further bolstered by some other signals. We are coming out of a relatively strong string of sales days over the Thanksgiving weekend, traditionally the “opening” of the holiday sales cycle. While sales on Thursday and Black Friday were at the lower end of predicted estimates, they still set records over previous years. With a lot of tech like smartphones often bought online, this could point to stronger numbers for smartphone sales as well.

On top of that, last week IDC — which also tracks and analyses smartphones sales — published a report predicting that sales would grow 2.4% in Q4 compared to 2019’s Q4. Its take is that while 5G smartphones will drive buying, prices still need to come down on these newer generation handsets to really see them hit with wider audiences. The average selling price for a 5G-enabled smartphone in 2020 is $611, said IDC, but it thinks that by 2024 that will come down to $453, likely driven by Android-powered handsets, which have collectively dominated smartphone sales for years.

Indeed, in terms of brands, Samsung, with its Android devices, continued to lead the pack in terms of overall units, with 80.8 million units, and a 22% market share. In fact, the Korean handset maker and China’s Xiaomi were the only two in the top five to see growth in their sales in the quarter, respectively at 2.2% and 34.9%. Xiaomi’s numbers were strong enough to see it overtake Apple for the quarter to become the number-three slot in terms of overall sales rankings. Huawei just about held on to number two. See the full chart further down in this story with more detail.

Also worth noting: Overall mobile sales — a figure that includes both smartphones and feature phones — were down 8.7% to 401 million units. That underscores not just how few feature phones are selling at the moment (smartphones can often even be cheaper to buy, depending on the brands involved or the carrier bundles), but also that those less sophisticated devices are seeing even more sales pressure than more advanced models.

It’s worth remembering that even before the global health pandemic, smartphone sales were facing slowing growth. The reasons: After a period of huge enthusiasm from consumers to pick up devices, many countries reached market penetration. And then, the latest features were too incremental to spur people to sell up and pay a premium on newer models.

In that context, the big hope from the industry has been 5G, which has been marketed by both carriers and handset makers as having more data efficiency and speed than older technologies. Yet when you look at the wider roadmap for 5G, rollout has remained patchy, and consumers by and large are still not fully convinced they need it.

Notably, in this past quarter, there is still some evidence that emerging/developing markets continue to have an impact on growth — in contrast to new features being drivers in penetrated markets.

“Early signs of recovery can be seen in a few markets, including parts of mature Asia/Pacific and Latin America. Near normal conditions in China improved smartphone production to fill in the supply gap in the third quarter which benefited sales to some extent,” said Anshul Gupta, senior research director at Gartner, in a statement. “For the first time this year, smartphone sales to end users in three of the top five markets i.e., India, Indonesia and Brazil increased, growing 9.3%, 8.5% and 3.3%, respectively.”

The more positive Q3 figures coincide with a period this summer that saw new COVID-19 cases slowing down in many places and the relaxation of many restrictions, so now all eyes are on this coming holiday period, at a time when COVID-19 cases have picked up with a vengeance, and with no rollout (yet) of large-scale vaccination or therapeutic programs. That is having an inevitable drag on the economy.

“Consumers are limiting their discretionary spend even as some lockdown conditions have started to improve,” said Gupta of the Q3 numbers. “Global smartphone sales experienced moderate growth from the second quarter of 2020 to the third quarter. This was due to pent-up demand from previous quarters.”

Digging into the numbers, Samsung has held on to its top spot, although its growth was significantly less strong in the quarter. Even with that slump, Samsung is still a long way ahead.

That is in part because number-two Huawei, with 51.8 million units sold, was down by more than 21% since last year. It has been having a hard time in the wake of a public relations crisis after sanctions in the U.S. and U.K., due to accusations that its equipment is used by China for spying. (Those U.K. sanctions, indeed, have been brought up in timing, just as of last night.)

That also led Huawei earlier this month to confirm the long-rumored plan to sell off its Honor smartphone division. That deal will involve selling the division, reportedly valued at around $15 billion, to a consortium of companies.

It will be interesting to see how Apple’s small decline of 0.6% to 40.6 million units to Xiaomi’s 44.4 million will shift in the next quarter on the back of the company launching a new raft of iPhone 12 devices.

“Apple sold 40.5 million units in the third quarter of 2020, a decline of 0.6% as compared to 2019,” said Annette Zimmermann, research vice president at Gartner, in a statement. “The slight decrease was mainly due to Apple’s delayed shipment start of its new 2020 iPhone generation, which in previous years would always start mid/end September. This year, the launch event and shipment start began 4 weeks later than usual.”

Oppo, which is still not available through carriers or retail partners in the U.S., rounded out the top five sellers with just under 30 million phones sold. The fact that it and Xiaomi do so well despite not really having a phone presence in the U.S. is an interesting testament to what kind of role the U.S. plays in the global smartphone market: huge in terms of perception, but perhaps less so when the chips are down.

“Others” — that category that can take in the long tail of players who make phones, continues to be a huge force, accounting for more sales than any one of the top five. That underscores the fragmentation in the Android-based smartphone industry, but all the same, its collective numbers were in decline, a sign that consumers are indeed slowly continuing to consolidate around a smaller group of trusted brands.

| Vendor | 3Q20

Units |

3Q20 Market Share (%) | 3Q19

Units |

3Q19 Market Share (%) | 3Q20-3Q19 Growth (%) |

| Samsung | 80,816.0 | 22.0 | 79,056.7 | 20.3 | 2.2 |

| Huawei | 51,830.9 | 14.1 | 65,822.0 | 16.9 | -21.3 |

| Xiaomi | 44,405.4 | 12.1 | 32,927.9 | 8.5 | 34.9 |

| Apple | 40,598.4 | 11.1 | 40,833.0 | 10.5 | -0.6 |

| OPPO | 29,890.4 | 8.2 | 30,581.4 | 7.9 | -2.3 |

| Others | 119,117.4 | 32.5 | 139,586.7 | 35.9 | -14.7 |

| Total | 366,658.6 | 100.0 | 388,807.7 | 100.0 | -5.7 |

Source: Gartner (November 2020)

Just a few weeks back, we learned that Apple would be launching an “App Store Small Business Program” that would reduce its fees from 30% to 15% for developers earning less than $1M per year from the App Store.

That program is starting to roll out now, with Apple opening up the enrollment process just this morning.

Apple outlines the program here, with a few things standing out:

Apple says that if you enroll by December 18th, reduced fees should be active by January 1st of 2021. Existing developers can still enroll after that cutoff, but things get a bit more complicated, with reduced fees generally kicking in midway through the next fiscal calendar month.

Apple has always gone out of its way to build features for users with disabilities, and VoiceOver on iOS is an invaluable tool for anyone with a vision impairment — assuming every element of the interface has been manually labeled. But the company just unveiled a brand new feature that uses machine learning to identify and label every button, slider and tab automatically.

Screen Recognition, available now in iOS 14, is a computer vision system that has been trained on thousands of images of apps in use, learning what a button looks like, what icons mean and so on. Such systems are very flexible — depending on the data you give them, they can become expert at spotting cats, facial expressions or, as in this case, the different parts of a user interface.

The result is that in any app now, users can invoke the feature and a fraction of a second later every item on screen will be labeled. And by “every,” they mean every — after all, screen readers need to be aware of every thing that a sighted user would see and be able to interact with, from images (which iOS has been able to create one-sentence summaries of for some time) to common icons (home, back) and context-specific ones like “…” menus that appear just about everywhere.

The idea is not to make manual labeling obsolete — developers know best how to label their own apps, but updates, changing standards and challenging situations (in-game interfaces, for instance) can lead to things not being as accessible as they could be.

I chatted with Chris Fleizach from Apple’s iOS accessibility engineering team, and Jeff Bigham from the AI/ML accessibility team, about the origin of this extremely helpful new feature. (It’s described in a paper due to be presented next year.)

“We looked for areas where we can make inroads on accessibility, like image descriptions,” said Fleizach. “In iOS 13 we labeled icons automatically — Screen Recognition takes it another step forward. We can look at the pixels on screen and identify the hierarchy of objects you can interact with, and all of this happens on device within tenths of a second.”

The idea is not a new one, exactly; Bigham mentioned a screen reader, Outspoken, which years ago attempted to use pixel-level data to identify UI elements. But while that system needed precise matches, the fuzzy logic of machine learning systems and the speed of iPhones’ built-in AI accelerators means that Screen Recognition is much more flexible and powerful.

It wouldn’t have been possible just a couple of years ago — the state of machine learning and the lack of a dedicated unit for executing it meant that something like this would have been extremely taxing on the system, taking much longer and probably draining the battery all the while.

But once this kind of system seemed possible, the team got to work prototyping it with the help of their dedicated accessibility staff and testing community.

“VoiceOver has been the standard-bearer for vision accessibility for so long. If you look at the steps in development for Screen Recognition, it was grounded in collaboration across teams — Accessibility throughout, our partners in data collection and annotation, AI/ML, and, of course, design. We did this to make sure that our machine learning development continued to push toward an excellent user experience,” said Bigham.

It was done by taking thousands of screenshots of popular apps and games, then manually labeling them as one of several standard UI elements. This labeled data was fed to the machine learning system, which soon became proficient at picking out those same elements on its own.

It’s not as simple as it sounds — as humans, we’ve gotten quite good at understanding the intention of a particular graphic or bit of text, and so often we can navigate even abstract or creatively designed interfaces. It’s not nearly as clear to a machine learning model, and the team had to work with it to create a complex set of rules and hierarchies that ensure the resulting screen reader interpretation makes sense.

The new capability should help make millions of apps more accessible, or just accessible at all, to users with vision impairments. You can turn it on by going to Accessibility settings, then VoiceOver, then VoiceOver Recognition, where you can turn on and off image, screen and text recognition.

It would not be trivial to bring Screen Recognition over to other platforms, like the Mac, so don’t get your hopes up for that just yet. But the principle is sound, though the model itself is not generalizable to desktop apps, which are very different from mobile ones. Perhaps others will take on that task; the prospect of AI-driven accessibility features is only just beginning to be realized.

Google announced this morning Android phones will receive an update this winter that will bring some half-dozen new features to devices, including improvements to apps like Gboard, Google Play Books, Voice Access, Google Maps, Android Auto, and Nearby Share. The release is the latest in a series of update bundles that now allow Android devices to receive new features outside of the usual annual update cycle.

The bundles may not deliver Android’s latest flagship features, but they offer steady improvements on a more frequent basis.

One of the more fun bits in the winter update will include a change to “Emoji Kitchen,” the feature in the Gboard keyboard app that lets users combine their favorite emoji to create new ones that can be shared as customized stickers. To date, users have remixed emoji over 3 billion times since the feature launched earlier this year, Google says. Now, the option is being expanded. Instead of offering hundreds of design combinations, it will offer over 14,000. You’ll also be able to tap two emoji to see suggested combinations or double tap on one emoji to see other suggestions.

Image Credits: Google

This updated feature had been live in the Gboard beta app, but will now roll out to Android 6.0 and above devices in the weeks ahead.

Another update will expand audiobook availability on Google Play Books. Now, Google will auto-generate narrations for books that don’t offer an audio version. The company says it worked with publishers in the U.S. and U.K. to add these auto-narrated books to Google Play Books. The feature is in beta but will roll out to all publishers in early 2021.

An accessibility feature that lets people use and navigate their phone with voice commands, Voice Access, will also be improved. The feature will soon leverage machine learning to understand interface labels on devices. This will allow users to refer to things like the “back” and “more” buttons, and many others by name when they are speaking.

The new version of Voice Access, now in beta, will be available to all devices worldwide running Android 6.0 or higher.

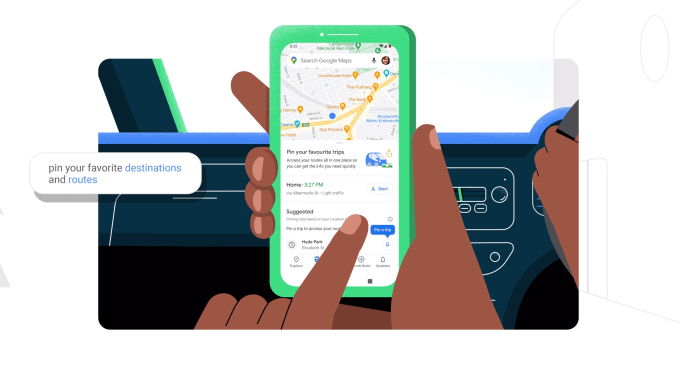

An update for Google Maps will add a new feature to one of people’s most-used apps.

In a new (perhaps Waze-inspired) “Go Tab,” users will be able to more quickly navigate to frequently visited places — like a school or grocery store, for example — with a tap. The app will allow users to see directions, live traffic trends, disruptions on the route, and gives an accurate ETA, without having to type in the actual address. Favorite places — or in the case of public transit users, specific routes — can be pinned in the Go Tab for easy access. Transit users will be able to see things like accurate departure and arrival times, alerts from the local transit agency, and an up-to-date ETA.

Image Credits: Google

One potentially helpful use case for this new feature would be to pin both a transit route and driving route to the same destination, then compare their respective ETAs to pick the faster option.

This feature is coming to both Google Maps on Android as well as iOS in the weeks ahead.

Android Auto will expand to more countries over the next few months. Google initially said it would reach 36 countries, but then updated the announcement language as the timing of the rollout was pushed back. The company now isn’t saying how many countries will gain access in the months to follow or which ones, so you’ll need stay tuned for news on that front.

Image Credits: Google

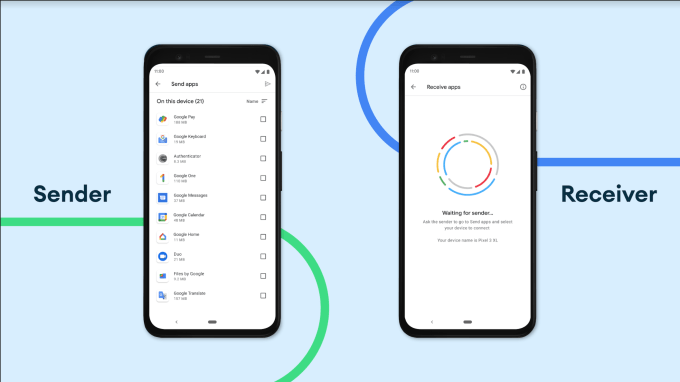

The final change is to Nearby Share, the proximity-based sharing feature that lets users share things like links, files, photos and and more even when they don’t have a cellular or Wi-Fi connection available. The feature, which is largely designed with emerging markets in mind, will now allow users to share apps from Google Play with people around them, too.

To do so, you’ll access a new “Share Apps” menu in “Manage Apps & Games” in the Google Play app. This feature will roll out in the weeks ahead.

Some of these features will begin rolling out today, so you may receive them earlier than a timeframe of several “weeks,” but the progress of each update will vary.

Apple has always gone out of its way to build features for users with disabilities, and Voiceover on iOS is an invaluable tool for anyone with a vision impairment — assuming every element of the interface has been manually labeled. But the company just unveiled a brand new feature that uses machine learning to identify and label every button, slider, and tab automatically.

Screen Recognition, available now in iOS 14, is a computer vision system that has been trained on thousands of images of apps in use, learning what a button looks like, what icons mean, and so on. Such systems are very flexible — depending on the data you give them, they can become expert at spotting cats, facial expressions, or as in this case the different parts of a user interface.

The result is that in any app now, users can invoke the feature and a fraction of a second later every item on screen will be labeled. And by “every,” they mean every — after all, screen readers need to be aware of every thing that a sighted user would see and be able to interact with, from images (which iOS has been able to create one-sentence summaries of for some time) to common icons (home, back) and context-specific ones like “…” menus that appear just about everywhere.

The idea is not to make manual labeling obsolete — developers know best how to label their own apps, but updates, changing standards, and challenging situations (in-game interfaces, for instance) can lead to things not being as accessible as they could be.

I chatted with Chris Fleizach from Apple’s iOS accessibility engineering team, and Jeff Bigham from the AI/ML accessibility team, about the origin of this extremely helpful new feature. (It’s described in a paper due to be presented next year.)

“We looked for areas where we can make inroads on accessibility, like image descriptions,” said Fleizach. “In iOS 13 we labeled icons automatically – Screen Recognition takes it another step forward. We can look at the pixels on screen and identify the hierarchy of objects you can interact with, and all of this happens on device within tenths of a second.”

The idea is not a new one, exactly; Bigham mentioned a screen reader, Outspoken, which years ago attempted to use pixel-level data to identify UI elements. But while that system needed precise matches, the fuzzy logic of machine learning systems and the speed of iPhones’ built-in AI accelerators means that Screen Recognition is much more flexible and powerful.

It wouldn’t have been possibly just a couple years ago — the state of machine learning and the lack of a dedicated unit for executing it meant that something like this would have been extremely taxing on the system, taking much longer and probably draining the battery all the while.

But once this kind of system seemed possible, the team got to work prototyping it with the help of their dedicated accessibility staff and testing community.

“VoiceOver has been the standard bearer for vision accessibility for so long. If you look at the steps in development for Screen Recognition, it was grounded in collaboration across teams — Accessibility throughout, our partners in data collection and annotation, AI/ML, and, of course, design. We did this to make sure that our machine learning development continued to push toward an excellent user experience,” said Bigham.

It was done by taking thousands of screenshots of popular apps and games, then manually labeling them as one of several standard UI elements. This labeled data was fed to the machine learning system, which soon became proficient at picking out those same elements on its own.

It’s not as simple as it sounds — as humans, we’ve gotten quite good at understanding the intention of a particular graphic or bit of text, and so often we can navigate even abstract or creatively designed interfaces. It’s not nearly as clear to a machine learning model, and the team had to work with it to create a complex set of rules and hierarchies that ensure the resulting screen reader interpretation makes sense.

The new capability should help make millions of apps more accessible, or just accessible at all, to users with vision impairments. You can turn it on by going to Accessibility settings, then VoiceOver, then VoiceOver Recognition, where you can turn on and off image, screen, and text recognition.

It would not be trivial to bring Screen Recognition over to other platforms, like the Mac, so don’t get your hopes up for that just yet. But the principle is sound, though the model itself is not generalizable to desktop apps, which are very different from mobile ones. Perhaps others will take on that task; the prospect of AI-driven accessibility features is only just beginning to be realized.