We are now into the all-important holiday sales period, and new numbers from Gartner point to some recovery underway for the smartphone market as vendors roll out a raft of new 5G handsets.

Q3 smartphone figures from the analysts published today showed that smartphone unit sales were 366 million units, a decline of 5.7% globally compared to the same period last year. Yes, it’s a drop; but it is still a clear improvement on the first half of this year, when sales slumped by 20% in each quarter, due largely to the effects of COVID-19 on spending and consumer confidence overall.

That confidence is being further bolstered by some other signals. We are coming out of a relatively strong string of sales days over the Thanksgiving weekend, traditionally the “opening” of the holiday sales cycle. While sales on Thursday and Black Friday were at the lower end of predicted estimates, they still set records over previous years. With a lot of tech like smartphones often bought online, this could point to stronger numbers for smartphone sales as well.

On top of that, last week IDC — which also tracks and analyses smartphones sales — published a report predicting that sales would grow 2.4% in Q4 compared to 2019’s Q4. Its take is that while 5G smartphones will drive buying, prices still need to come down on these newer generation handsets to really see them hit with wider audiences. The average selling price for a 5G-enabled smartphone in 2020 is $611, said IDC, but it thinks that by 2024 that will come down to $453, likely driven by Android-powered handsets, which have collectively dominated smartphone sales for years.

Indeed, in terms of brands, Samsung, with its Android devices, continued to lead the pack in terms of overall units, with 80.8 million units, and a 22% market share. In fact, the Korean handset maker and China’s Xiaomi were the only two in the top five to see growth in their sales in the quarter, respectively at 2.2% and 34.9%. Xiaomi’s numbers were strong enough to see it overtake Apple for the quarter to become the number-three slot in terms of overall sales rankings. Huawei just about held on to number two. See the full chart further down in this story with more detail.

Also worth noting: Overall mobile sales — a figure that includes both smartphones and feature phones — were down 8.7% to 401 million units. That underscores not just how few feature phones are selling at the moment (smartphones can often even be cheaper to buy, depending on the brands involved or the carrier bundles), but also that those less sophisticated devices are seeing even more sales pressure than more advanced models.

Smartphone slump: It’s not just COVID-19

It’s worth remembering that even before the global health pandemic, smartphone sales were facing slowing growth. The reasons: After a period of huge enthusiasm from consumers to pick up devices, many countries reached market penetration. And then, the latest features were too incremental to spur people to sell up and pay a premium on newer models.

In that context, the big hope from the industry has been 5G, which has been marketed by both carriers and handset makers as having more data efficiency and speed than older technologies. Yet when you look at the wider roadmap for 5G, rollout has remained patchy, and consumers by and large are still not fully convinced they need it.

Notably, in this past quarter, there is still some evidence that emerging/developing markets continue to have an impact on growth — in contrast to new features being drivers in penetrated markets.

“Early signs of recovery can be seen in a few markets, including parts of mature Asia/Pacific and Latin America. Near normal conditions in China improved smartphone production to fill in the supply gap in the third quarter which benefited sales to some extent,” said Anshul Gupta, senior research director at Gartner, in a statement. “For the first time this year, smartphone sales to end users in three of the top five markets i.e., India, Indonesia and Brazil increased, growing 9.3%, 8.5% and 3.3%, respectively.”

The more positive Q3 figures coincide with a period this summer that saw new COVID-19 cases slowing down in many places and the relaxation of many restrictions, so now all eyes are on this coming holiday period, at a time when COVID-19 cases have picked up with a vengeance, and with no rollout (yet) of large-scale vaccination or therapeutic programs. That is having an inevitable drag on the economy.

“Consumers are limiting their discretionary spend even as some lockdown conditions have started to improve,” said Gupta of the Q3 numbers. “Global smartphone sales experienced moderate growth from the second quarter of 2020 to the third quarter. This was due to pent-up demand from previous quarters.”

Digging into the numbers, Samsung has held on to its top spot, although its growth was significantly less strong in the quarter. Even with that slump, Samsung is still a long way ahead.

That is in part because number-two Huawei, with 51.8 million units sold, was down by more than 21% since last year. It has been having a hard time in the wake of a public relations crisis after sanctions in the U.S. and U.K., due to accusations that its equipment is used by China for spying. (Those U.K. sanctions, indeed, have been brought up in timing, just as of last night.)

That also led Huawei earlier this month to confirm the long-rumored plan to sell off its Honor smartphone division. That deal will involve selling the division, reportedly valued at around $15 billion, to a consortium of companies.

It will be interesting to see how Apple’s small decline of 0.6% to 40.6 million units to Xiaomi’s 44.4 million will shift in the next quarter on the back of the company launching a new raft of iPhone 12 devices.

“Apple sold 40.5 million units in the third quarter of 2020, a decline of 0.6% as compared to 2019,” said Annette Zimmermann, research vice president at Gartner, in a statement. “The slight decrease was mainly due to Apple’s delayed shipment start of its new 2020 iPhone generation, which in previous years would always start mid/end September. This year, the launch event and shipment start began 4 weeks later than usual.”

Oppo, which is still not available through carriers or retail partners in the U.S., rounded out the top five sellers with just under 30 million phones sold. The fact that it and Xiaomi do so well despite not really having a phone presence in the U.S. is an interesting testament to what kind of role the U.S. plays in the global smartphone market: huge in terms of perception, but perhaps less so when the chips are down.

“Others” — that category that can take in the long tail of players who make phones, continues to be a huge force, accounting for more sales than any one of the top five. That underscores the fragmentation in the Android-based smartphone industry, but all the same, its collective numbers were in decline, a sign that consumers are indeed slowly continuing to consolidate around a smaller group of trusted brands.

| Vendor |

3Q20

Units

|

3Q20 Market Share (%) |

3Q19

Units

|

3Q19 Market Share (%) |

3Q20-3Q19 Growth (%) |

| Samsung |

80,816.0 |

22.0 |

79,056.7 |

20.3 |

2.2 |

| Huawei |

51,830.9 |

14.1 |

65,822.0 |

16.9 |

-21.3 |

| Xiaomi |

44,405.4 |

12.1 |

32,927.9 |

8.5 |

34.9 |

| Apple |

40,598.4 |

11.1 |

40,833.0 |

10.5 |

-0.6 |

| OPPO |

29,890.4 |

8.2 |

30,581.4 |

7.9 |

-2.3 |

| Others |

119,117.4 |

32.5 |

139,586.7 |

35.9 |

-14.7 |

| Total |

366,658.6 |

100.0 |

388,807.7 |

100.0 |

-5.7 |

Source: Gartner (November 2020)

from iPhone – TechCrunch https://ift.tt/33qyaok

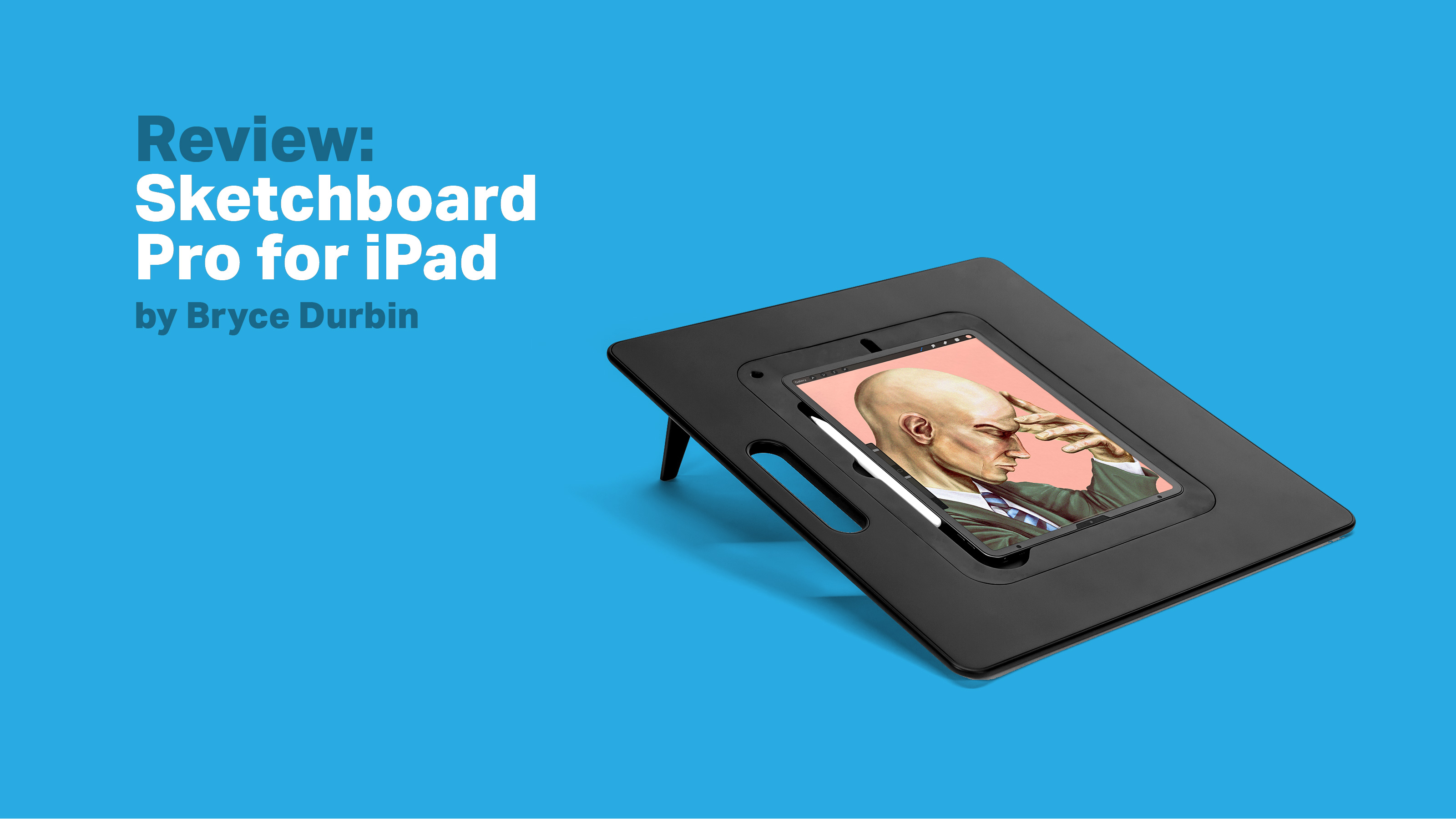

![[text] The Sketchboard Pro is an iPad stand designed for artists. It’s compatible with over 30 sizes of iPad. It retails for $119. There are spots for placing an Apple Pencil upright or connected to the iPad for charging as well as openings for the camera and power cable. The iPad fits snugly so the entire surface is flat. [image: Three views of the Sketchboard Pro from overhead, one empty, one with an iPad being inserted as well as a power cord and one with an iPad in place.]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-02.jpg)

![[text] There are four pop-out legs on the back so the board can stand (with two legs at a time) at an angle in any direction. The board measures 19.5 x 17 inches (49.5 x 43.2 cm). [image: two back views of the Sketchboard Pro, one with legs collapsed and one with legs out.]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-03.jpg)

![[text] The Sketchboard Pro sits at a 20 degree angle and weighs 4.5 lbs (about 2 kg). It can also stand upright like an easel, but I found this position to be less stable. [image: side views of the Sketchboard Pro to demonstrate a 20 degree angle]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-04.jpg)

![[text] I tested the Sketchboard Pro with a 12.9” iPad (2019). Combined, they weighed about 5.6 lbs (2.54 kg). I found the board easy to use at a desk or table, but more cumbersome in casual settings such as a couch. [image: illustrations of holding the Sketchboard Pro by the handle and sitting and drawing]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-05.jpg)

![[text] The Sketchboard Pro is a handy accessory for artists who work extensively on the iPad. I’d recommend it if you’re looking for a digital drawing setup to mimic a traditional drafting table and hoping to save your posture. [image: an illustration of the Sketchboard Pro]](https://techcrunch.com/wp-content/uploads/2020/11/sketchboard-pro-review-06.jpg)